Is the “70/30 Rule of Thumb” in Market Demand Studies Accurate?

March 17, 2021

Is your investment strategy to split sales with competitors or take market share? Has a development site been identified or is a proposed site being considered? Does a project’s marketing strategy need to be fine-tuned to meet pro forma projections? Or are you hunting for new sales opportunities for an expansion? Regardless of the rationale, the origins and characteristics of where recent seniors housing residents lived are among the most meaningful indicators of future purchase behavior.

Depending upon an area’s target market population density and considering the type of property under study (whether it serves an independent living, assisted living, memory care or nursing care resident), many seniors housing market analysts use generalized assumptions or “rules of thumb” in determining demand.

Referred to as the “70/30” rule, it is broadly estimated that 70% of a property’s residents will come from within a defined primary market area (PMA). But a PMA can be defined in many ways. Some of the more common methods used by market analysts include drawing a 3-mile, 5-mile or 10-mile radius around an existing property or a potential development site (depending on the care segment level served), using drive-time mapping technology to define the limits of how far prospective residents and/or their adult children will travel to the property from where they live or work based on unique traffic patterns and geographic and psychological barriers, and constructing polygons of Zip Codes, U.S. Census Tracts, or Block Groups.

For this analysis, which seeks to determine if data confirms the 70/30 rule, a 10-mile radius is assumed to be the PMA from which a community would attract the majority of its residents. Resident Origin, a product offering of VisionLTC, powered by NIC MAP Vision, is the first data set of its kind in the senior housing industry that provides clients with insight into the resident relocation patterns of 15,000+ seniors housing communities nationwide, illustrating the effective resident draw radius over the past 12- to 18-month time frame.

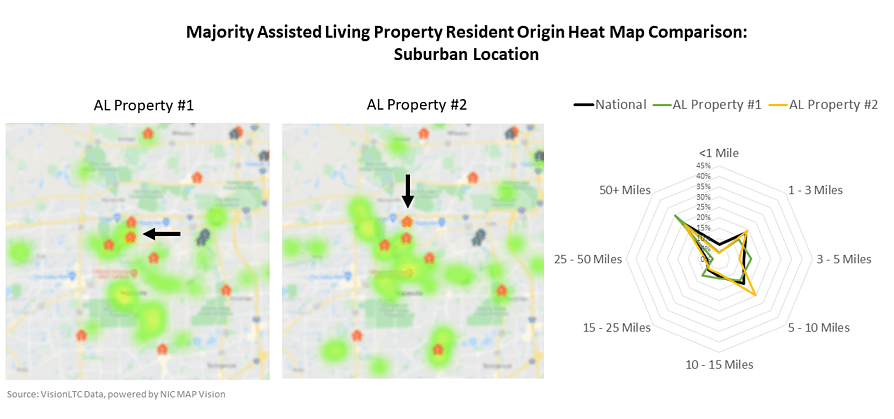

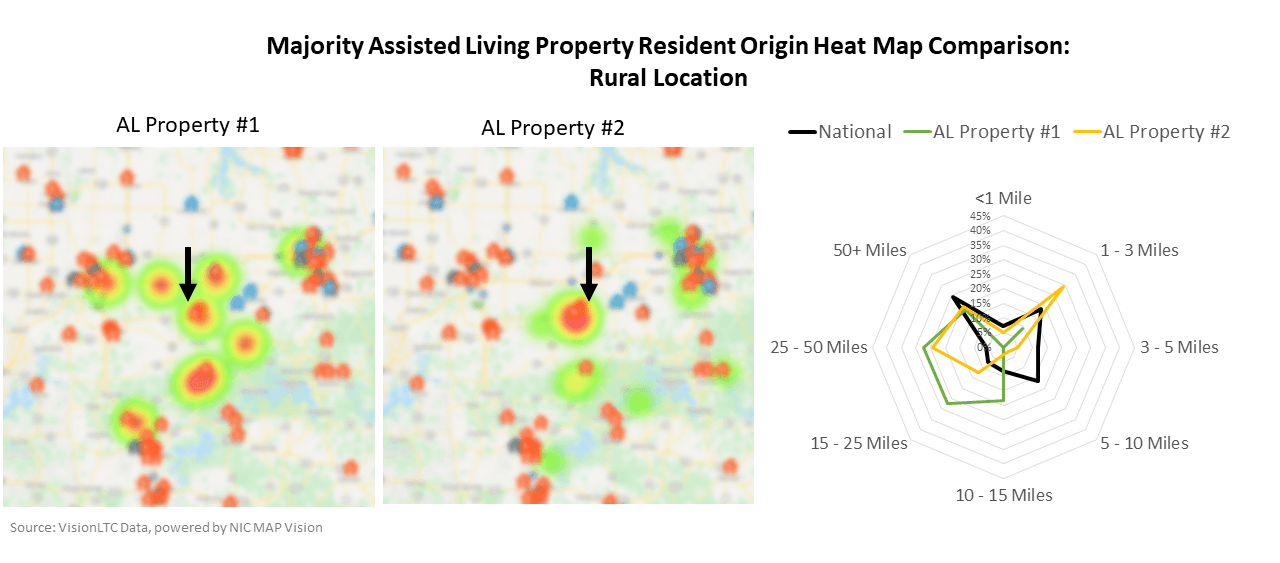

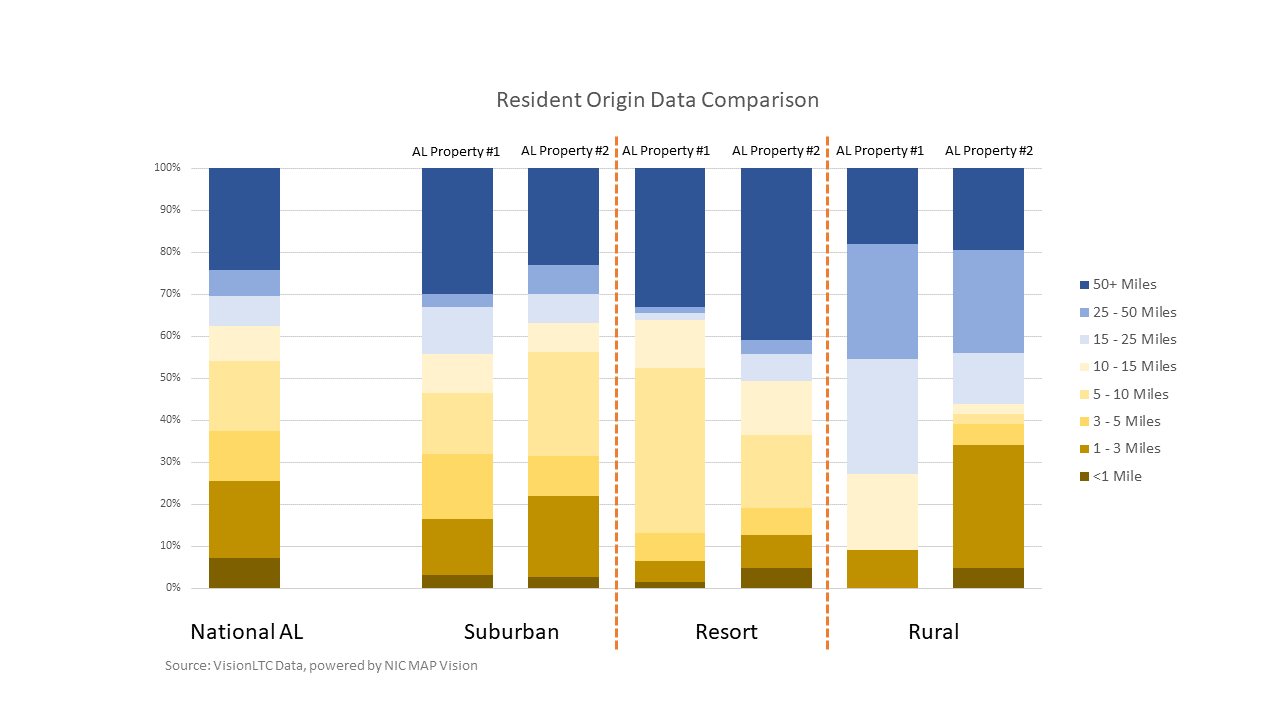

The following maps and charts describe the migration patterns of residents of nearby assisted living properties (within 1 to 2.5 miles from each other) in three different geographies: a leafy suburb of a major U.S. city—a mountain retreat vacation destination, and—a typical rural U.S. community. The green, yellow and red colorings on the maps represent the concentrations of where the subject property’s residents lived before moving into the property.

- As shown by the Resident Origin maps of two assisted living properties in the suburban geography, located within one mile of each other, the resident origin data for both properties is relatively homogenous—both properties have attracted residents from the same general areas with a significant amount of overlap. However, the chart shows that the distribution of residents in miles does not confirm the “70/30” rule—the two suburban geography properties only attract 46% and 56% of their residents from within a 10-mile radius. Said another way, 54% and 46% are attracting residents from outside the PMA.

- Looking at the maps of two assisted living properties in the resort destination geography, located within 2.5 miles of each other, Resident Origin data for both properties shows varied areas from where residents are drawn. AL property #1 attracts more residents from areas north of the Interstate Highway, including the nearby city, while AL property #2 appears to take share from within the neighborhood served by another assisted living property located along and to the west side of an alternate highway. The chart shows that the distribution of residents in miles, like the suburban geography example, does not confirm the “70/30” rule. The two resort destination geography properties attract 52% and 37% of their residents from a 10-mile radius. Said another way, 48% and 63% are attracting residents from outside their PMAs.

- The maps below show both a broad and localized pattern of resident-draw typically seen in rural areas. AL property #1, located within the town, attracts more of its residents from neighboring towns than its competitor. AL property #2, located on the edge of the town, appeals primarily to local residents even though both properties are situated within 2-miles of each other. Consistent with the suburban and resort destination geography examples, the chart shows that the distribution of residents in miles, the two rural geography assisted living properties do not fit the “70/30” rule. AL property #2 attracts 42% of its residents from within 10-miles, whereas only 9% of AL property #1 residents come to the community from within 10-miles. Or said another way, AL property #2 is drawing 58% of its residents from outside the PMA and AL property #1 is pulling a full 91% of its residents from outside the PMA.

These maps and charts clearly illustrate the need for an analyst to understand the share of residents relocating from outside of the market area and which neighborhoods residents are relocating from as mileage does vary depending on different conditions. Additionally, many other factors can be considered when determining possible drivers of differences in resident origins among competitors:

- National or brand-name awareness

- Proximity to where adult children live and/or work

- Built and natural boundaries, such as highways, bridges or rivers, and the location of major services such as hospitals and shopping centers influence how and where people travel

- Zip Code, county, and political and neighborhood boundaries

- Congruence of psychographic and socioeconomic profiles of current and past residents

- Reputation, signage, and curb appeal

- Comparability of the buildings to the character of neighborhood/geography

- Monthly services fees comparable to neighborhood home sales prices

- Building age differences

- Recent or chronic management/leadership/ownership turnover

- Staffing challenges and/or turnover

- Size of marketing budgets, skill of marketing staff, and quality of outreach due to better developed referral sources

- Specific religious affiliation or affinity group alignment

So how well does the 70/30 “rule of thumb” apply? On a national basis, the 70/30 rule is a close approximation when applying a 50-mile primary market area as “in-market” origin. According to VisionLTC data, 75.7% of seniors chose communities less than 50-miles from their homes (in-market) while the remaining 24.3% of seniors chose communities more than 50-miles from their homes (out-of-market). However, the distance a resident or family member is willing to move or travel or visit varies in urban, suburban, and rural markets and by the type of care being sought. The resulting PMA typically serves a much smaller area than 50-miles.

VisionLTC’s Resident Origin data allows the analyst to develop more accurate market areas rather than guessing—and to quickly fine tune a primary market area based on actual relocation patterns and not just assumptions or “rules of thumb.”

About NIC MAP Vision:

NIC MAP Vision is a leading provider of comprehensive market data for the seniors housing and care sector. NIC MAP Vision brings together two strong, well-respected, and complementary teams and platforms – the market-leading NIC MAP® Data Service (NIC MAP) and VisionLTC’s best-in-class market research analysis platform. .

About Author Lana Peck

Lana Peck, a senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.