Senior Housing Delinquencies Decline in 2Q2021, and Other Lending Trends

November 12, 2021

NIC Analytics recently released the 2Q2021 NIC Lending Trends report, a free report available now. The quarterly report tracks over $86.9 billion in senior housing and nursing care loans including construction loans, mini-perm/bridge loans, and permanent loans from the third quarter of 2016 through the second quarter of 2021. The NIC Lending Trends Report helps to deliver on NIC’s mission to enable access and choice by further enhancing transparency of capital market trends in the senior housing and care sector.

Below are a few key takeaways from the NIC Lending Trends Report for second quarter 2021. Access the full report on nic.org.

Takeaways from the 2Q21 report.

-

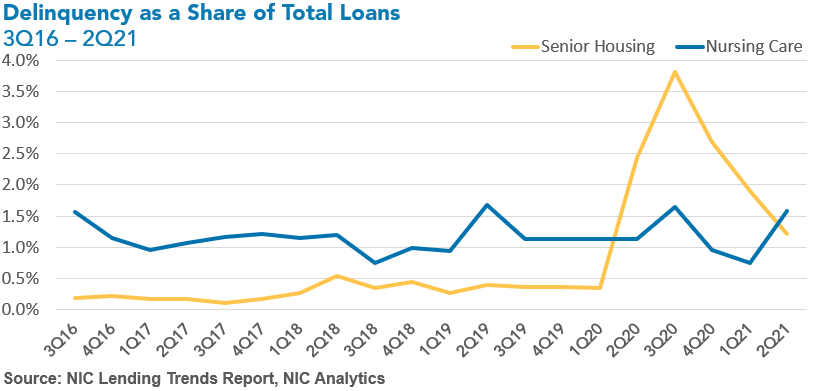

Delinquent loans, which include loans in forbearance for some lenders, had a marked improvement for senior housing during the second quarter. Delinquencies as a share of total loans for senior housing declined for the third consecutive quarter following the recorded peak of 3.8% in 3Q2020 and stood at 1.2% in the second quarter. However, nursing care delinquencies as a share of total loans increased from 0.8% in 1Q2021 to 1.6%.

-

The volume of new closed construction loans increased in 2Q2021 for both senior housing and nursing care as lenders became more comfortable in development activity following four quarters of slowing activity related to the pandemic. Newly closed construction loans jumped 46.7% for senior housing on a same-store quarter-over-quarter basis, the highest recorded quarterly increase since 4Q2017. For nursing care, the same-store quarter-over-quarter growth was even larger at 71.4%, but this was off of a relatively small base. Note that second quarter 2021 data includes construction refinancing for some lenders.

-

New permanent loan issuance for senior housing increased in 2Q2021, with a same-store increase of 46.3%, the largest same-store quarter-over-quarter increase since 3Q2019. Nursing care permanent loan issuance slipped lower in 2Q2021, hitting its recorded low point since the beginning of the time series in mid-2016. On a same-store quarter-over-quarter basis new permanent loans were down -25.5% in 2Q2021, the largest same-store drop since 1Q2020.

These data are not to be interpreted as a census of all senior housing and skilled nursing lending activity in the U.S., but rather reflect lending activity from participants included in the survey sample only.

The 3Q2021 NIC Lending Trends Report is scheduled for release in early February 2022.

Interested in participating? We very much appreciate our data contributors. This report would not be possible without them. If you would like to participate and contribute your data, please email us at analytics@nic.org. The information provided as part of the survey will be kept strictly confidential. Individual responses will be combined with those of all other respondents. Data acquired from this survey will only be reported in the aggregate, and therefore, the resulting aggregated data will not be attributed to you or your company upon distribution. As a thank you for providing data, data contributors receive this report early before publication on the website.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.