Allocating Competitive Beds in Feasibility Studies

March 28, 2017

Executive Summary / Key Takeaways

- Competitive Bed Allocation is the process of determining how many competitive beds will be counted against your project. This number will be used to establish penetration rates, market capacity, competitive market trends and characteristics, and a range of other very important key performance indicators.

- There are two common methods of allocating competitive beds:

-

- Point Allocation – if a competing facility is located in the primary market area (PMA), 100% of its beds count against the project. If a competitor is outside of the PMA, then none of its beds count against the project.

- PMA Overlap Allocation – a consistent primary market area is drawn around all competing communities and the percentage overlap of the competitor’s market area with the subject site’s market area is multiplied by the total number of beds. E.g. If a competitor’s 5-mile primary market area overlaps 50% with that of a 100-bed competitor located ~4 miles away, then 50 beds will be counted against the project.

-

- As demonstrated in the graphic below, these two methods can generate competitive bed allocations for the exact same scenario that differ by more than 50%. For most site and market evaluations, that’s the difference between go and no-go.

- These methods each have drawbacks:

-

- Point Allocation – if you use a 5 mile PMA and have 0 competitors within 5 miles but 10 competitors within 5.1 miles, then your project may look significantly better than it actually is, since it will show no “competition” despite having a considerable amount.

- PMA Buffer Overlap – if your site is on a river’s edge and a competitor is located on the other side of that river and your market area only overlaps over the river itself (and the nearest bridge is 30 minutes away), then using the PMA Buffer Overlap method will lead to an over-allocation of beds against your project. In addition, the PMA Buffer Overlap Method is very computationally intense and is beyond the capacity of most off-the-shelf GIS systems.

-

- PMA Buffer Overlap is preferable since it more accurately replicates the way that the world actually works. In fact, Point Allocation is internally inconsistent – you are assuming that your site will draw from a 5-mile radius, while you are assuming that your competitors will fill all of their beds from inside of your market area, instead of drawing from their own 5-mile PMA.

- However, PMA Buffer has the drawbacks stated above – so it is often impractical and can still produce false positives and negatives.

- Fortunately, new technology allows for the simultaneous use of both and the efficient side-by-side comparison of the results to determine if and where outliers occur for further investigation.

- Recommendation: Use new technology packages to run both methods simultaneously. Benchmark them. Compare them side-by-side and identify significant outliers. Where outliers occur, dive deeper and determine why the outlier exists and which method is more accurate.

Allocation Method Overview

For the first installment of Feasibility Studies 101, we address a topic that is most certainly not at the top of your minds – how to determine how many “competitive beds” your senior housing project will be competing against. While this may seem pretty far in the weeds – it’s important. Billions of dollars of capital are invested in new development projects each year in part based on the results of penetration and feasibility studies. Studies whose outcomes are determined in large part by how and what competitive beds are counted “against” the project.

By now, most know that the results of a feasibility study can be altered by disqualifying competition – it’s a Medicaid facility, it’s a rest home, etc. – so it doesn’t compete with my project. But did you know that the results of a feasibility study can also be dramatically altered by changing how competitive beds are allocated? Consider the two most common ways of allocating competition:

Allocation Method Overview

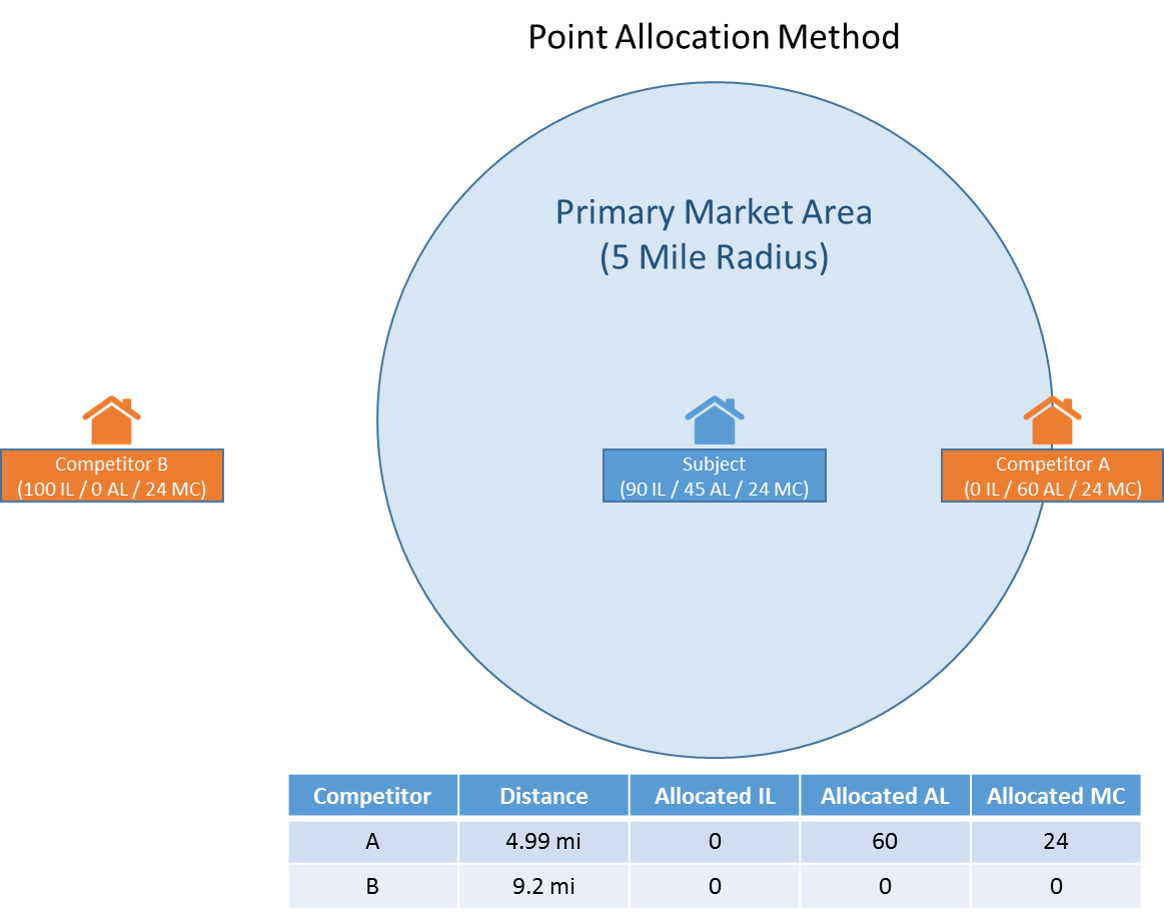

Point Allocation: If a competing facility is located in the primary market area, 100% of its beds count against the project. The logic here is simple – if the competitor is in the PMA, you have to compete against all of its beds, not just some. If a competitor is outside of the PMA, then you compete against none of its beds.

In terms of execution, this method is pretty simple – all you need is a set of coordinates and a Haversine formula (though you have to be careful about distortions based on the curvature of the earth). Also, a basic GIS tool can run this analysis in a matter of a few seconds.

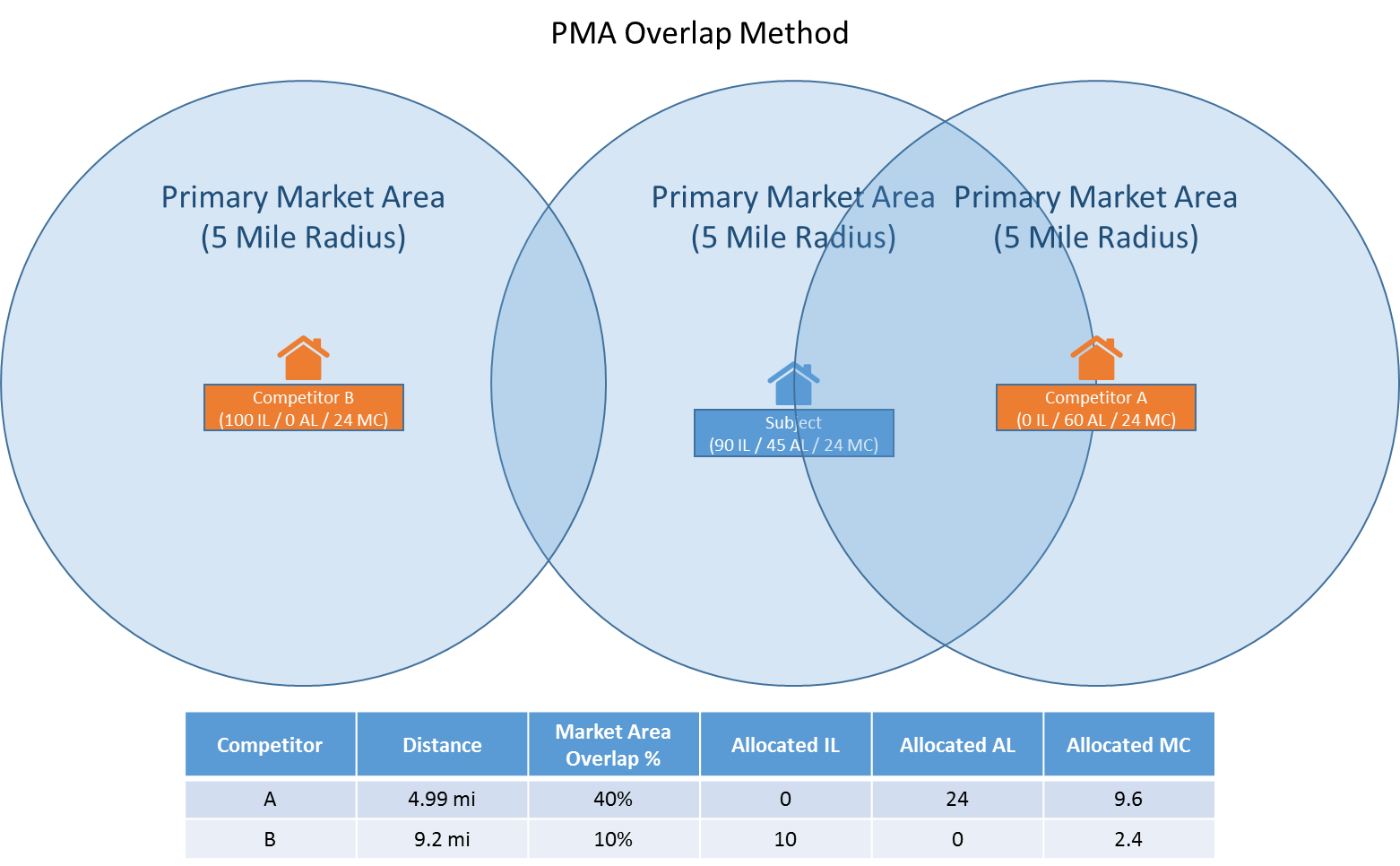

PMA Overlap Allocation: A consistent primary market area (E.g. 5-mile radius) is drawn around all competing communities and the percentage overlap of the competitor’s market area with the subject market area is multiplied by the total number of beds. E.g. If a competitor’s 5-mile primary market area overlaps 50% with that of a 100-bed competitor located ~4 miles away, then 50 beds will be counted against the project. This approach is the logical replication of what you’re doing for your feasibility study – if you assume that you will draw from a five mile radius around your proposed project, shouldn’t that same logic apply to your competitors? In that case, a project 9 miles away will still be pulling from a part of the market that you are counting on, so you will compete against that competitor in proportion to the overlap in your market areas times the number of the competitor’s beds.

In terms of execution, this method is a bit more complex – first, you need to calculate the distance between the competitors and your site (again, using the Haversine formula). Then, you have to use the formula for the area of intersection of two circles to get the overlap between the PMAs. Unfortunately, this sort of analysis often befuddles off-the-shelf GIS tools and this is a reason often cited for preferring Point Allocation.

Here’s an example of the same scenario under each method:

vs.

As you can see, by simply changing the allocation method, we increase the number of IL beds counted against the project from 0 to 10, while reducing the number of AL beds by 60% and the number of MC beds by 50%. The bottom line is that how you allocate competitive beds matters and it matters a lot.

So which is “right” you might ask. The answer is – it depends.

Allocation Method Shortcomings

Imagine a market where a large number of competitors were aligned in a ring exactly 5.0001 miles away from your site but not a single one was closer. If you used a 5 mile radius, then you might think – great – no competition. But that would be wrong. Very wrong. Because all of those competitors are going to draw from your market area and you are in for a fierce fight. This would be a classic failure of Point Allocation.

Another shortcoming of Point Allocation is the issue of arbitrariness. Five miles, 15 minutes, or whatever PMA you use isn’t exact, so why should a competitor that is .01 miles inside of your PMA count 100% and one that is .01 miles outside of your PMA count 0%? By selecting what is a reasonably, but ultimately arbitrary cut off (5 miles, 15 minutes, etc.), and counting only the competition inside that radius, you arbitrarily omit competition that will in fact impact you.

But on the other hand – take a look at the graphic above for PMA Overlap Method. Now imagine that Competitor A was on a 4.8 mile long, 100 yard wide peninsula jutting out into the sea. This peninsula has no inhabitants except for Competitor A’s grand community. In that case, it would be erroneous to conclude that Competitor A will draw from a nice 5 mile radius, since most of that radius will cover open ocean. So instead of counting 40% of its beds against your project, you should likely count something closer to 70% or 80%.

An additional challenge with the PMA Overlap method is simply the computational intensity of running the overlap. Determining what falls within 5 miles of a site is easy – a set of coordinates and the Haversine formula will pretty much do it. With PMA Overlap, you need a lot more powerful computing and GIS software and if you try to run it at any scale, say for a national benchmark cohort set, all off-the-shelf GIS tools (ArcMap, QGIS, etc.) will fail.

The bottom line here is that both methods have shortcomings, especially in edge cases. So what should we do? Which method should we prefer?

Choosing a Competition Allocation Method

If forced to choose between the two methods, we here at VisionLTC would prefer PMA overlap. In our opinion, it more accurately affects the way the real world works. If you have a prospective resident who lives 4.9 miles from your community and 4.9 miles from a comparable competitor that is 9.8 miles away from yours, you are competing with that community. You’re only competing with that community for a small number of residents, those that live directly in the middle of the two communities, but you are competing with them. This is exactly how the PMA Overlap Method works. And while there are edge cases where the PMA Overlap Method under allocates beds, it does so less frequently and less considerably than the Point Allocation Method. So if forced to choose, we’d go with PMA Overlap.

But wait – wouldn’t it be better if we didn’t have to choose. We here at VisionLTC believe in what we call a “Comprehensive Outlier-Focused Strategy.” To explain it simply, we believe in running as many different analyses as possible, benchmarking them, and then examining large outliers more deeply. In general, this means that we’d run as many different feasibility formulas as possible, benchmark them, and then identify which formulas produce outlier values and dig deeper.

In the case of allocating competition, we believe the right answer is to use both methods, for both the site in question and the benchmark set, and then look at the variance between the two methods on each metric, in addition to the variance from benchmark. What we’ve found is that in most cases, the results between the two methods are relatively similar – usually within a few percent. However, in the edge cases described above, major variances can occur. When variances do occur, we can then look a bit closer and determine what’s going on – is this a case of the 5.01 mile cluster or the peninsula case – and then determine which approach makes more sense to use.

Great – we’ll just do both. The challenge with this approach is the sheer intensity – time, computational, and analytical – of running these analyses. If you have a reasonably large benchmark set, you’ll quickly find that off-the-shelf GIS tools simply aren’t up to the job (the vaunted ArcMap usually fails once it has to overlap more than a few hundred PMAs). Then you have to pull a massive amount of data, apply a large set of computationally intense analytics, and then make sense of the results. It’s no wonder that most folks just pick a method and shy away from benchmarking.

Overcoming Technical Hurdles

VisionLTC was started by operators who wanted a more robust and scientific approach to market and site evaluation. When we found that off-the-shelf GIS products weren’t up to the challenge, we teamed up with luminaries in the GIS technology field and built our own. The result was VisionLTC. With VisionLTC, you don’t have to choose a competition allocation method. Instead, in as little as a minute’s time, you can run an infinite number of analyses that use both competition allocation methods, benchmark the results against any cohort that you select, and access the tools and insights you need to understand the results. That way, something as in-the-weeds as “Competitive Bed Allocation” does lead you to erroneously accept or reject a particular site.

Conclusion

So what did we learn? We learned that competitive bed allocation while arcane, matters. A lot. The difference between the two methods can easily be the difference between approving a project and rejecting a project. What’s more, we learned that both methods of bed allocation have pros and cons and behave differently in different market conditions. Finally, we learned that recent advances in technology have freed us from the need to choose, so we can now use both and drill down on the areas where the two methods produce very different results.

So, next time you’re looking at a market analysis, be sure to ask – how did you allocate the competitive beds? Why did you select that method? And how do the market conditions make that method the most appropriate?

Happy hunting!

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.