Active Adult Data Now Available in the NIC MAP Vision Platform

October 17, 2022

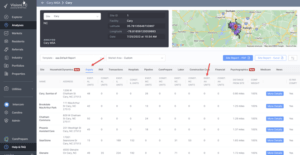

Earlier this summer, we officially announced the data collection and inclusion of Active Adult data in the NIC MAP Vision platform. Currently, that data includes property-level inventory information for 500+ Active Adult properties. Additional properties and performance data (rate and occupancy) will be added by early 2023.

Active Adult is the latest property type to be formally defined by our affiliate, the National Investment Center for Seniors Housing and Care (NIC), a move with the goal of improving transparency for the industry. The promotion and defining of Active Adult, an effort backed by industry experts alongside NIC, now draws the attention of operators, investors, developers, and other industry stakeholders interested in expanding into the property type.

“I think active adult is critical and that we have a responsibility to report data for this emerging property type,” NIC MAP Vision CEO Arick Morton said. “Everything you’re able to see and analyze for independent living, assisted living, memory care, and skilled nursing in our platform you’ll also be able to perform with active adult data by early next year.”

Defined by Senior Housing Stakeholders and NIC

The National Investment Center for Seniors Housing and Care (NIC) defined Active Adult as: Age-eligible, market rate, multi-family rental properties that are lifestyle focused; general operations do not provide meals.

The timing of this update aligns with the growing relevance of the Active Adult property type, which attracts older adults that want to live in a low-maintenance environment that supports their interests and connections with a community. Active Adult is now as important to track as the traditional senior living options such as independent living, assisted living, skilled nursing, and memory care.

What’s Behind the Shift to Active Adult?

Active Adult’s rising popularity seems tied to several factors, particularly the fact that people are living longer and that the now-retiring baby boomer population that will be over 85 million by 2025, appears more reluctant to embrace traditional senior housing options. With more active years ahead of them, older adults see active adult properties as a place that lies somewhere between the typical single-family home and traditional senior housing — a place more conducive for continuing a lifestyle on their terms within a supportive community.

Active Adult properties feature recreational areas, activity programming, and general grounds maintenance without housekeeping or meal planning. Because of the low-touch setup, these properties also tend to be more affordable, which also makes them more attractive to new residents.

“What we’re hearing time and time again is when a new active adult facility opens, 15 or 20 people move out of a local independent living facility and into an active adult facility,” Morton said. “If you don’t need three bundled meals a day, or two bundled meals a day, you can save yourself 50% by moving into an active adult community…With that development in mind, you’re really seeing active adult compete in the senior housing continuum.”

What’s Next?

What’s Next?

As mentioned, we’ll be adding Active Adult performance data by early 2023, which clients can then use for analyses in the same way they’ve analyzed other property types in the platform. Like our other performance and inventory data, Active Adult data is sourced directly from operators.

To receive more updates and information about new Active Adult data as it’s included in the platform, join our email list.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.