Asking Rate Growth Remains High: Key Takeaways from the 3Q2022 NIC MAP Actual Rates Report

Data from the recently released 3Q2022 NIC MAP Actual Rates Report showed growth for asking rates remained high on a year-over-year basis for all three care segments (independent living, assisted living, and memory care) for the data contributors to this data collection. In the recently released report, monthly data of actual rates and leasing velocity are presented through September 2022, including data on rate discounting and move-in/move-out trends. Key takeaways from the report, specifically from the Segment Type report, are presented below. Care segments refer to the levels of care and services provided to a resident living in an assisted living, memory care or independent living unit.

Key Takeaways

-

- The year-over-year growth in all rates for all care segments remained relatively strong through September 2022.

- For memory care, initial rates were up by 10.2% from year-earlier levels in September. This was the largest increase since the time series began (except for April 2022) among the three tracked rate categories (in-place, asking, and initial/move-in).

- At 9.9% in September, year-over-year asking rate growth for the independent living care segment was at its strongest pace since NIC MAP began reporting the data.

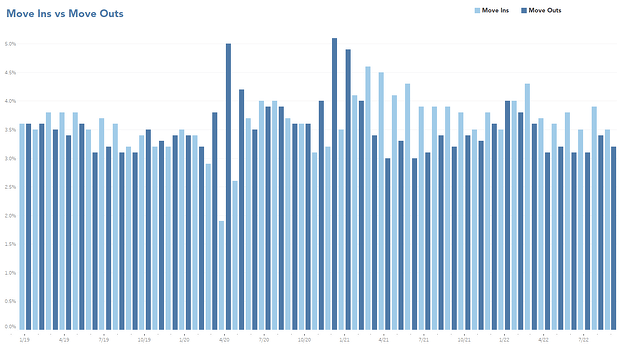

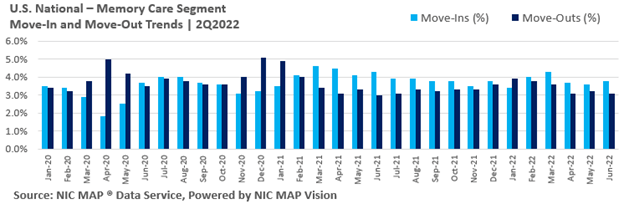

- For the past 19 months (since March 2021), the pace of move-ins has exceeded that of move-outs for all three care segments (independent living, assisted living, memory care).

- The memory care segment had the highest pace of move-ins of the three care segments in the third quarter at 3.6% of inventory on average. This was down from the recorded high of 4.6% of inventory in March of 2021, however.

- The weakest pace of churn was in independent living, where the pace of move-ins was at 2.3% of inventory in the third quarter. This compared favorably with a move-out rate of 2.1% of inventory, however, and supported gains in occupancy.

- Move-ins for assisted living segments averaged 3.5% of inventory in the third quarter, down from the recorded high of 3.9% in June 2021, but still relatively strong.

- Discounts are generally waning in the memory care and assisted living care segments.

- The year-over-year growth in all rates for all care segments remained relatively strong through September 2022.

NIC MAP continues to work to onboard new data contributors and is dedicated to reporting more metros. It is only with the support of Actual Rates data contributors and officially certified Actual Rates software partners that expanded metro-level reporting is now available. For more information on which metropolitan markets are now available to NIC MAP subscribers, please contact a product expert at NIC MAP today.

About the Report

The NIC MAP Seniors Housing Actual Rates Report provides aggregate national data from approximately 300,000 units within more than 2,600 properties across the U.S. operated by 25 to 30 senior housing providers. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as we currently require participating operators to manage 5 or more properties. Note that this monthly time series is comprised of end-of-month data for each respective month.

Interested in Participating?

The Actual Rates Data Initiative is an effort to expand senior housing data and we are looking for operators who have five or more properties to participate. NIC MAP has expertise in extracting data from industry leading software systems, such as Yardi, PointClickCare, Alis, MatrixCare, Glennis Solutions, Vitals, and Eldermark and can facilitate the process for you.

Operators contributing data to the actual rates report receive a complimentary report which allows them to compare their own data against national, and metropolitan market benchmarks.

In addition to receiving a complimentary report, your organization benefits through:

- More informed benchmarking, strategic planning, and day-to-day business operations,

- Increased transparency, aligning with other commercial real estate assets in terms of data availability,

- Saved time, Actual Rates data is collected electronically directly from operators’ corporate offices, removing the need for telephone calls to individual properties, and

- Enhanced investment and efficiency across the sector.