Ebbing Tides: The Ripple Effect of Declining Development in Senior Housing

Historical Context: Development Trends Pre-Pandemic**

Before the onset of the COVID-19 pandemic, the senior housing sector was already experiencing a deceleration in development—and there’s data to prove it. From 2016 to 2019, senior housing development across NIC MAP primary and secondary markets ranged from 60,000 to 70,000 units under construction every quarter. These steady development trends continued for three years, ranging between 6.5% to 7.5% of total senior housing inventory that could be considered “under construction.”

That multi-year peak in development may have felt promising, but it also led to concerns regarding oversupply, resulting in a general slowdown in new projects, concentrated in a few specific markets most in jeopardy of creating a surplus.

While some markets were already pulling back on their speed of construction, the pandemic only deepened this decline in development across the industry. Many markets struggled through a loss of occupied units, reduced consumer demand at the height of the pandemic, and financial restrictions that impacted capital and debt availability.

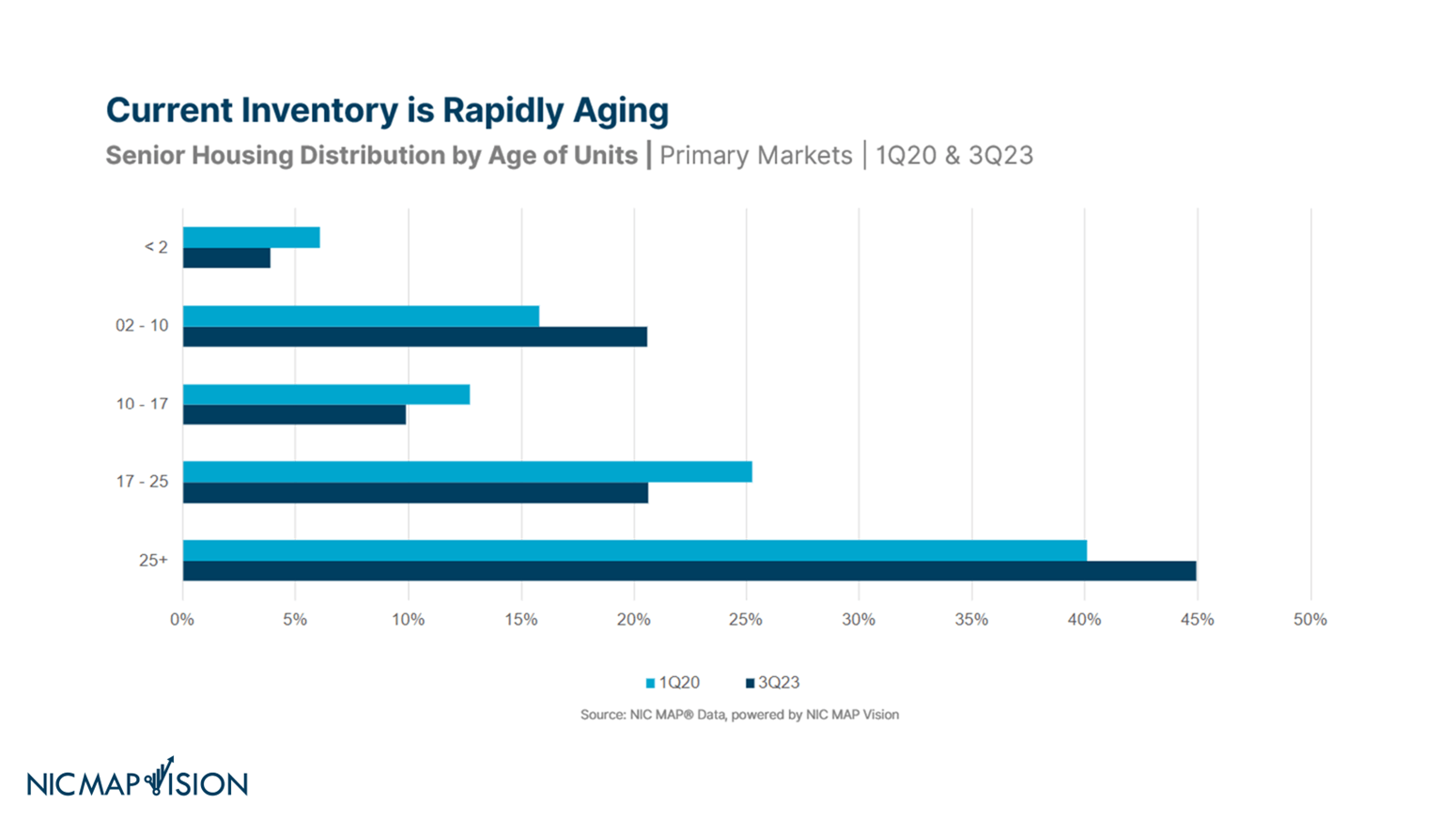

Current Inventory is Rapidly Aging

This chart brings to light a pressing concern within the senior housing industry: The existing inventory of senior housing is aging more rapidly than new developments are being introduced.

What does this mean? Prior to the pandemic, 40% of senior housing units in NIC MAP primary markets were housed within older communities that opened more than 25 years ago. But this trend has only grown over time. Today, that percentage of communities built over 25 years ago has increased to encompass 45% of the entire senior housing inventory. Because of the recent decline in new construction since the pandemic, this trend will only continue to increase in the near term.

This discrepancy is more than just a matter of numbers; it’s a question of meeting the evolving needs of future consumers. As buildings age, they may not only require significant maintenance and upgrades but may also fall short of modern expectations. Conversely, new, updated housing options with improved amenities, better aesthetics, and higher care capabilities are appealing to this target audience.

The rapid aging of the current inventory could potentially create a housing disconnect between what is available and what is desired. This concern is only amplified by the slowing pace of new developments in the senior housing sector. While the existing inventory continues to age, the pipeline for new, modern, and consumer-aligned housing is not growing at the pace needed to bridge this gap.

For stakeholders in the senior housing industry, this presents a strategic challenge. . It becomes crucial to reassess—and potentially rejuvenate—aging properties, while also strategically planning for new developments that align closely with current and future consumer expectations.

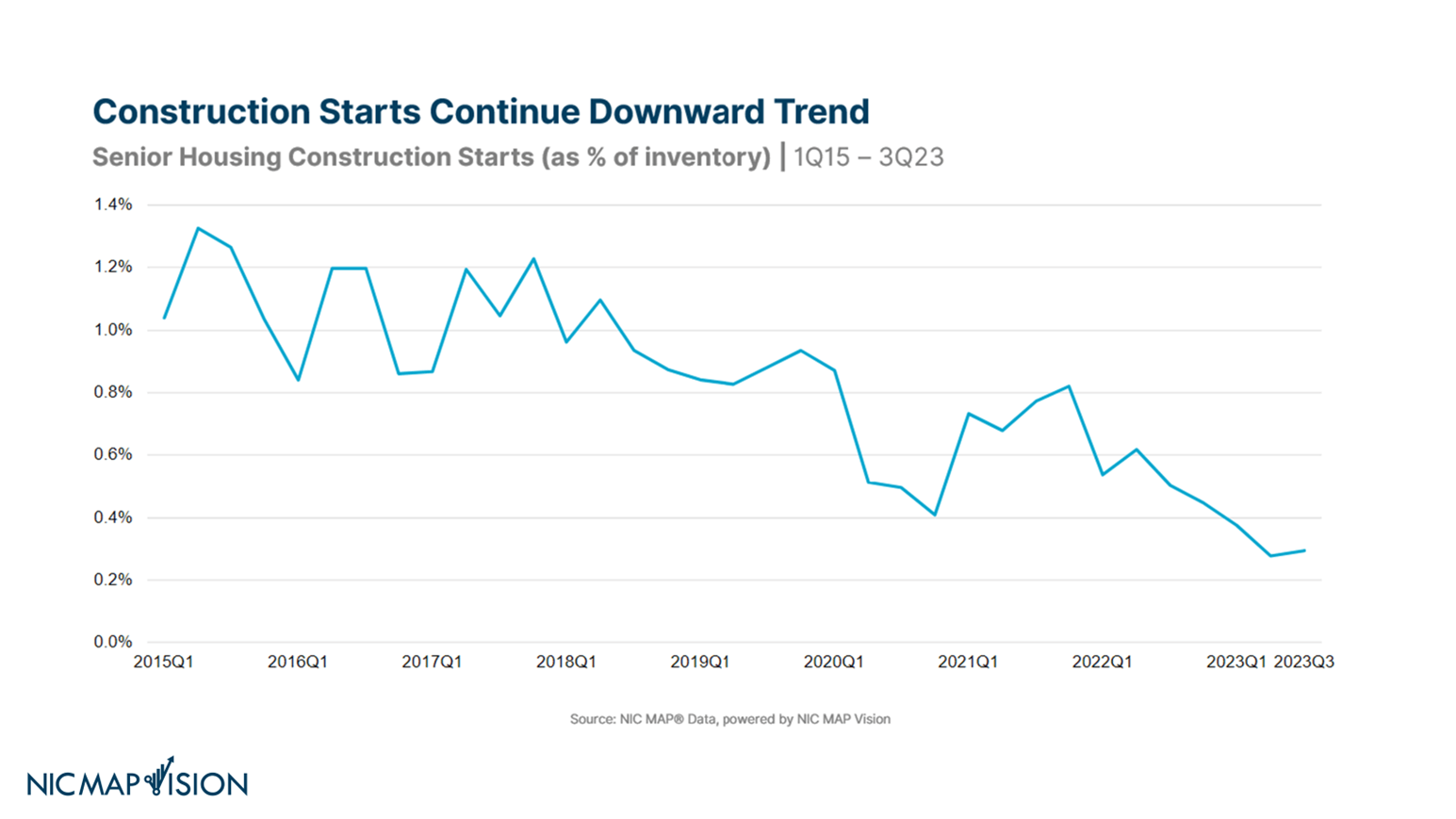

Financial Barriers and Development Starts: A Crucial Intersection

The slowdown in new senior housing developments has significantly affected the supply-and-demand dynamics within the industry. This decrease in new inventory presents a unique opportunity for occupancy gains across the industry. As shown in the graphic above, the senior housing sector is experiencing a significant trend: Construction starts are on a decline with no immediate signs of rebounding. This trend, while seemingly straightforward, carries with it a mixed bag of consequences that will impact many stakeholders in the industry.

Prior to the pandemic, the average number of units started for Senior Housing properties was approximately 10,000 units per quarter. When the pandemic started, this figure immediately dropped to about 5,000 starts for each of the last 3 quarters of 2020. And while there was a brief development boost from 2021 through the first half of 2022, that averaged just under 8,000 starts a quarter, start figures from the past year fell, resuming a slowed pace of less than 5,000 units per quarter.

On the positive side, the decline in construction starts can lead to much-needed stabilization within the market. With fewer new units coming online, existing properties may see an increase in occupancy rates. For operators and investors, this could translate to steadier returns and less volatility in the short term. Furthermore, market stabilization and increased occupancy rates will allow stakeholders to transition from occupancy recovery to margin recovery.

Additionally, y. Developers may take this opportunity to invest in upgrading existing properties or plan for future developments that will be better aligned with consumer expectations and market trends.

Even so, this current trend demonstrating a decline in construction starts is not without potential pitfalls. As the population ages and the demand for senior housing grows, an insufficient supply of new units may create an imbalance between demand and supply. If this decline in construction starts continues for an extended period, it could lead to a shortage of quality housing options for seniors. What’s more, it may set the scene for a mismatch between the evolving needs of future consumers and the available inventory. The new generation of seniors, likely to have different preferences and expectations, .

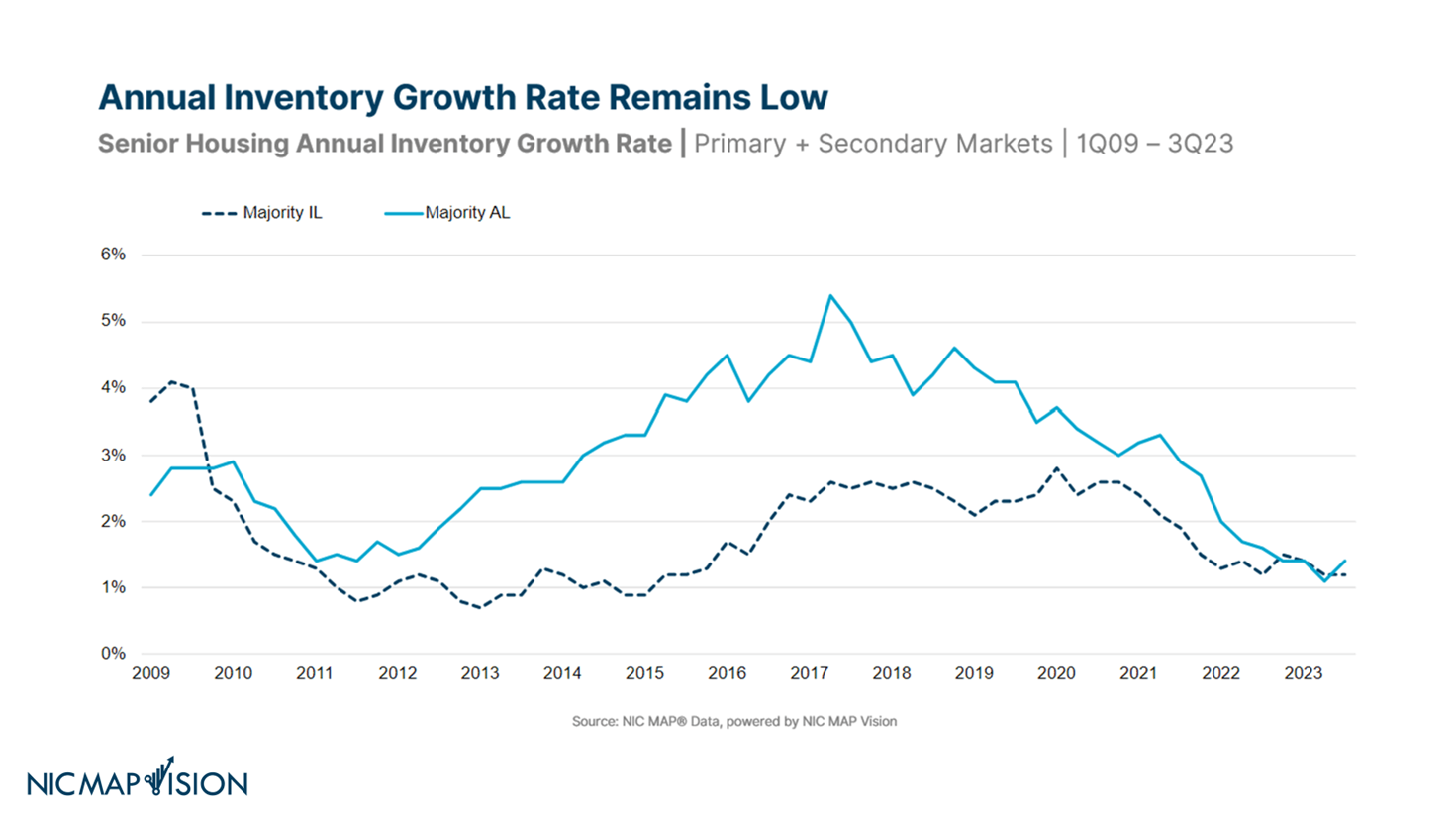

Uniform Slowdown: Independent Living and Assisted Living on Parallel Paths

As demonstrated in the graphic above, the industry’s slowdown in inventory growth is not selective to a particular type of senior housing. Rather, the decline in construction rates is the same across the board. Both Independent Living (IL) and Assisted Living (AL) facilities are experiencing similar declines in inventory growth.

This raises concerns about whether or not senior housing communities can adequately meet the diverse needs of the aging population. While some seniors may prefer Independent Living arrangements, others may require additional support that’s only offered in Assisted Living facilities. A uniform slowdown could potentially lead to a shortage of options that cater to these distinct needs.

Occupancy and Occupied Unit Trends: Adding Context

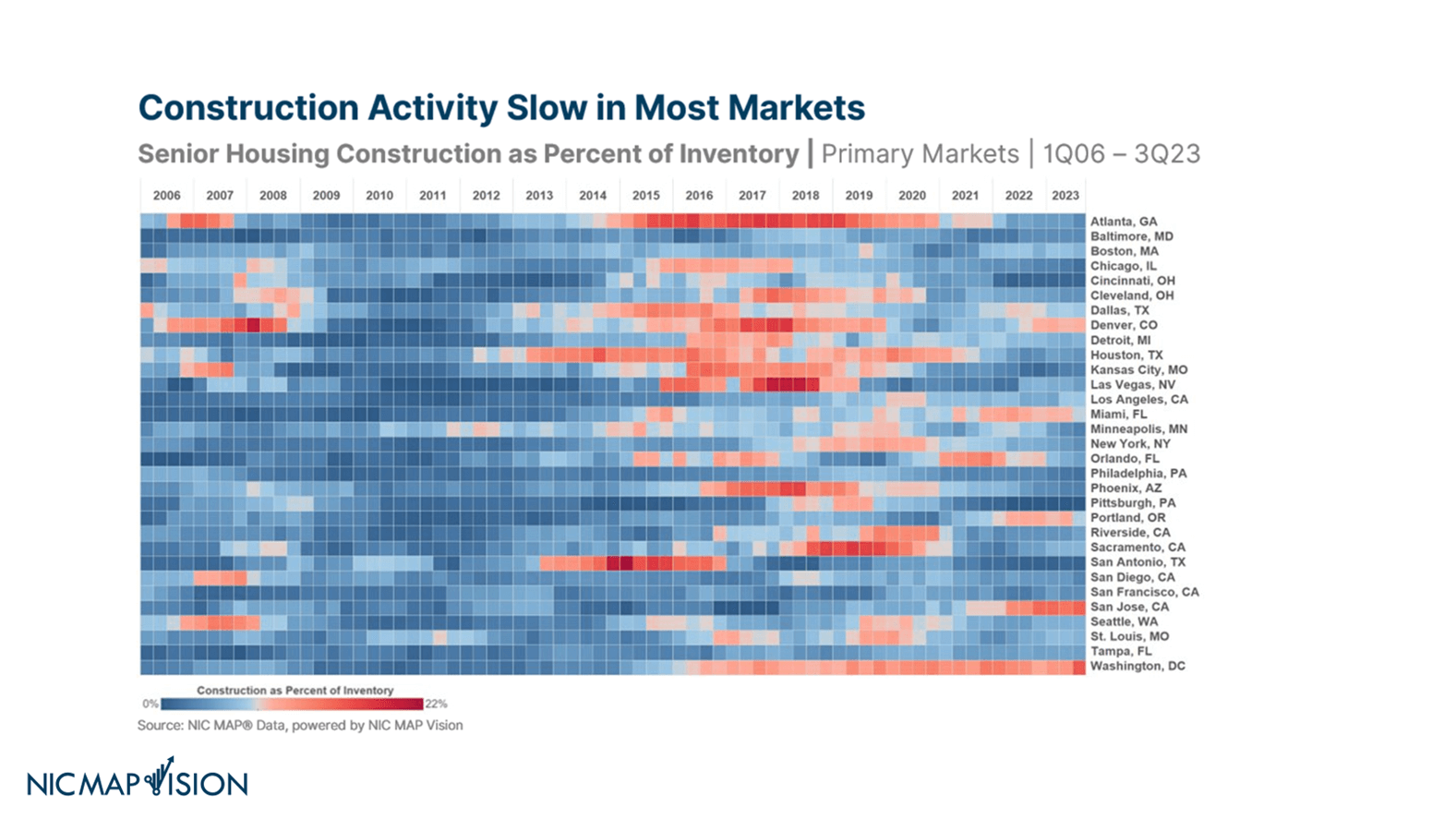

This graphic sheds light on an interesting aspect of the senior housing industry: The fact that construction trends in different markets often fluctuate, much like the ebb and flow of tides.

While we’ve already noted the overall decline from the peak development period between 2016 and 2019, certain metropolitan areas continue to showcase active development. This divergence in trends only emphasizes the dynamic nature of this industry, and just how important it is to stay updated regarding regional and local nuances.

Despite the overarching decline in new developments, a few metropolitan areas stand out as exceptions, actively pursuing new senior housing developments. These metros are bucking the trend, underscoring the fact that the senior housing landscape is not homogenous and can vary significantly based on regional and local factors. Examples of metropolitan areas with a high percentage of new developments include:

- Washington D.C.

- Denver

- Miami

- San Jose

Leveraging this kind of data is crucial to successfully navigate the complexities that exist in different markets. Comprehensive data on regional demographics, economic indicators, and existing senior housing landscapes can provide invaluable insights.

What’s Ahead

The senior housing industry is certainly going through a transformative phase thanks to the decline in construction starts. Despite this slowdown though, the industry remains poised for potential occupancy gains and even market stabilization.

What does this mean? The uniform decline in inventory growth across different types of senior housing presents an opportunity for innovation and improvements to meet the diverse needs of seniors comprehensively.

Looking forward, the slowdown in new inventory growth has resulted in where we are today, with a necessary strategic shift in focus for those looking to succeed in the coming years: An emphasis on , consumer-aligned offerings. While a few metropolitan areas continue to actively pursue new developments, the overall trend indicates a cautious and deliberate approach to growth. Thanks to this slowdown, coupled with an aging population, decision-makers will eventually need capital investment to develop additional inventory in the future.

Through all this evolution, the industry’s resilience is evident, as demonstrated by key milestones achieved amidst challenging times. The aging of existing inventory, paired with a decline in construction starts, creates a compelling case for future investments.

As demand is anticipated to grow alongside an aging population, the industry will be a promising landscape for investors and developers. By strategically planning and capitalizing on localized data and expertise, stakeholders can contribute to a thriving and responsive senior housing sector.

Stay ahead of the trends and stay resilient. Gain access to more of this invaluable data with NIC MAP. To learn more, connect with our team today!