Qualifying Demand? Why Income Isn’t Enough.

Now that we’ve talked about how some markets have pockets of untapped demand, I’d like to shift focus by posing two questions. How do seniors pay for their stay in senior-housing, and how are we, as an industry, qualifying seniors when we assess market demand?

When I read industry publications, feasibility studies, and talk to industry experts, everyone agrees that seniors need a minimum annual income to afford senior-housing without help from an adult child or other family member. The most common qualifying income I see is $35,000, which is closely followed by $50,000. But is income enough on its own?

No, it’s not. A study conducted by ASHA, NIC, and other contributors, as well as a study completed by the Center for Retirement Research at Boston College, found that many seniors who reside in senior housing do not have sufficient incomes to cover their monthly rent.

“The median basic monthly charge incurred by surveyed residents is $2,875, or almost $35,000 per year… The median annual income residents reported was a little more than half that amount, or $19,000.”

So how do seniors fill that gap? Asset spend down. Many seniors have accumulated wealth and assets over their lifetimes that can be converted into income (i.e. home or retirement fund). It is the combination of asset spend down and income that allows for seniors to fund their stay in assisted living facilities.

According to Genworth’s annual Cost of Care survey, the average cost for a private bed in an assisted living facility was $3,628 in 2016; an 11.3% increase since 2011. That’s nearly twice the rate of inflation, which increased by 6.7% from 2011 to 2016. Prices aren’t slowing down either, especially with the growth in supply in senior-housing, new communities entering the market have to make up for construction costs and hit critical capacity to start generating a profit for investors, while existing communities are raising prices to cover renovation and operating expenses. Regardless of the why, costs continue to rise and are expected to increase by 15.9% by 2021, according to Genworth’s estimates.

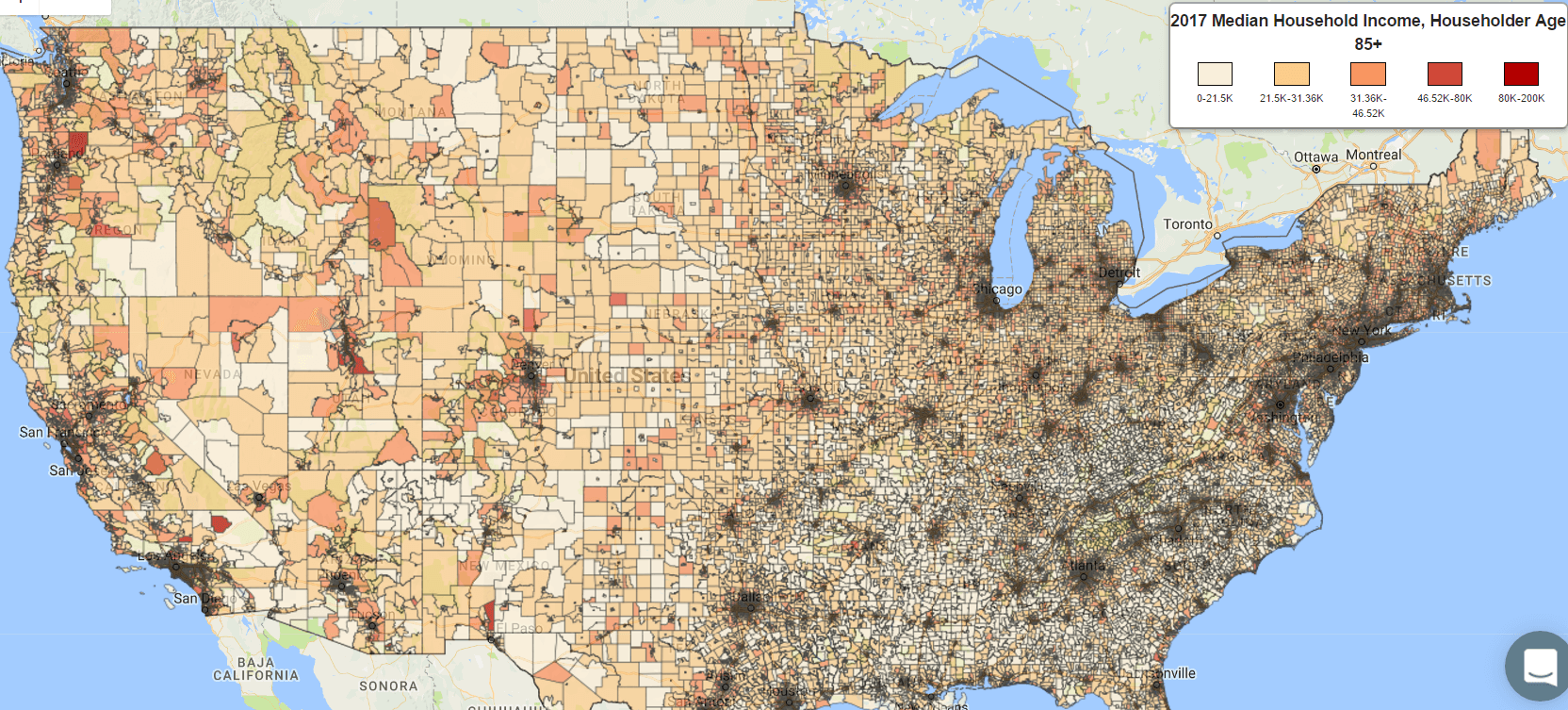

Using the VisionLTC platform, I analyzed the largest 386 MSAs in the USA for various income, net worth, and wealth statistics and compared them with Genworth’s cost by state data and found the following. Of the 386 markets examined, only 8 have median incomes for individuals 75 and older above the cost of an assisted living bed. When income is adjusted to include a net-worth spend down, 377 markets have median incomes above the cost of care. But this only compares the median, not the number of individuals. So, let’s dig deeper.

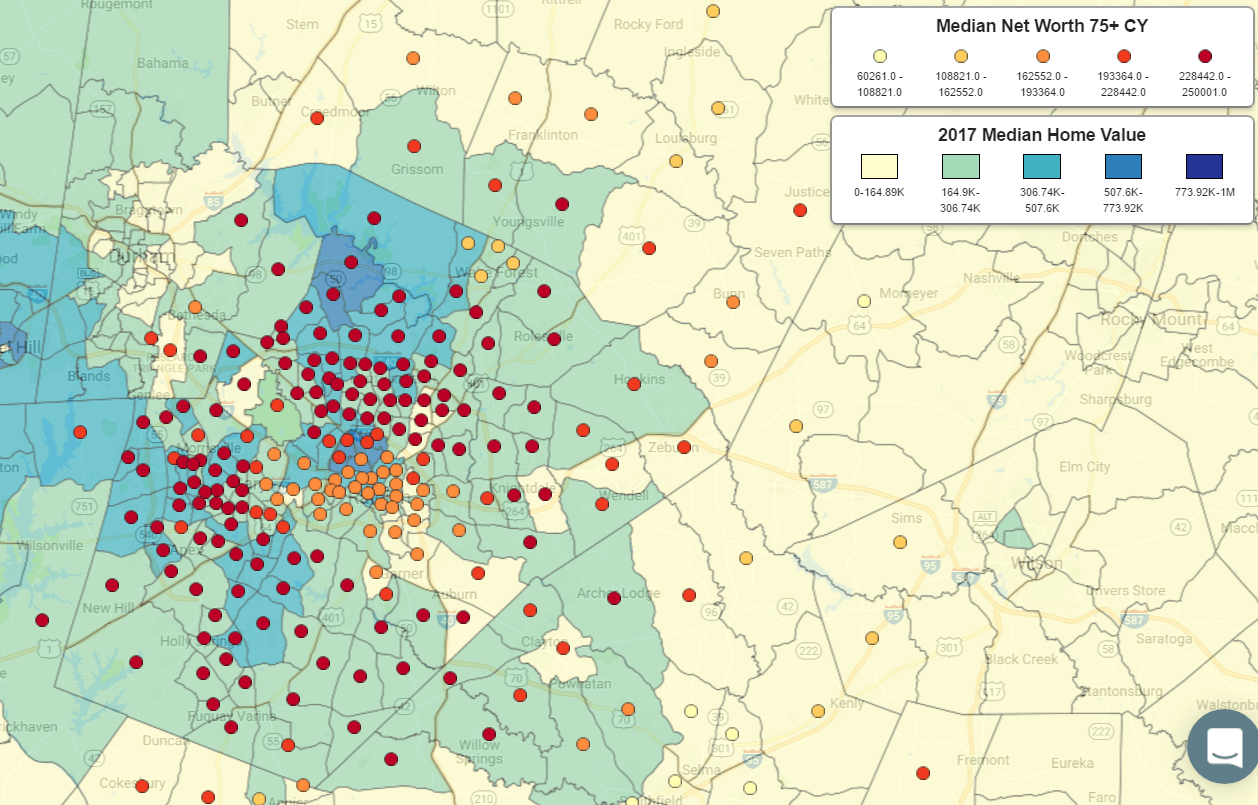

If we look at each of these markets for the number of income qualified individuals, using $35,000, $50,000 and $35,000 adjusted for new-worth spend down as the thresholds, we can see the stark differences in demand. Using $35,000 as the base case, there are an average of 13,121 individuals ages 75 and older with an income above $35,000 in a MSA. That number declines by 33% when the threshold is increased to $50,000, and the number increased by 98% when income is adjusted for net-worth spend down.

Why is this important? Two reasons. If you’re conducting a market study and are qualifying demand based on income, without regard for asset-spend-down, then you may be overlooking real opportunity. How many markets have you examined, and disregarded, because of poor income characteristics? Did you assess the net worth and assets of seniors in that market?

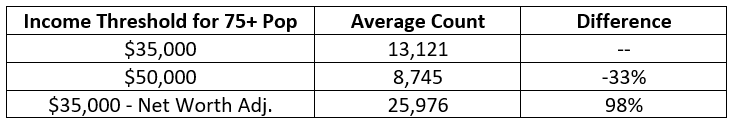

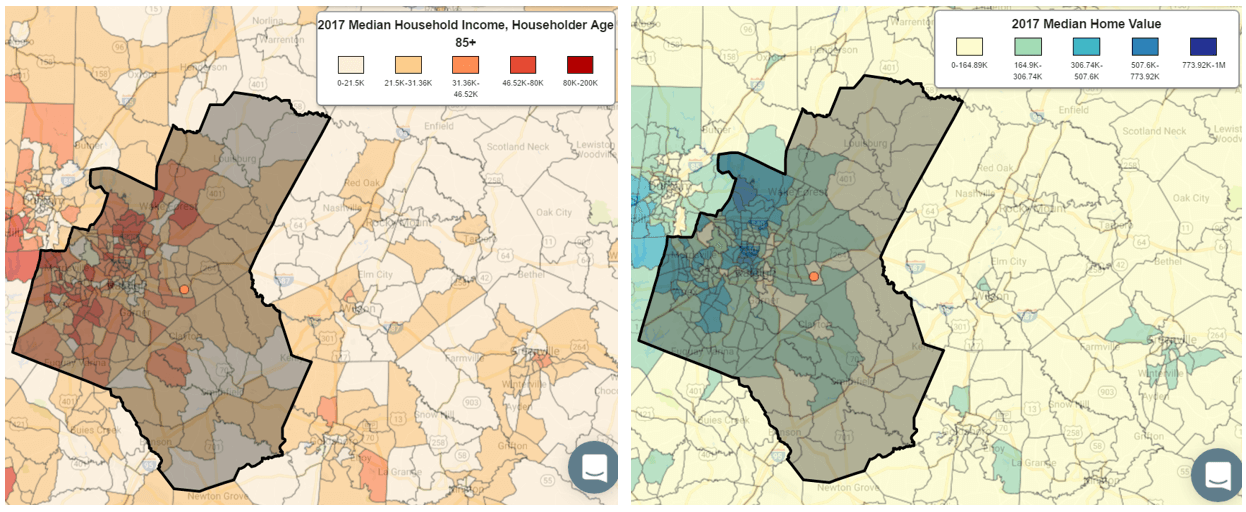

The second reason for assessing net-worth along with income, is the large variation of income and net-worth across markets. Take Raleigh, NC for example, VisionLTC’s home base. Raleigh is a top 50 MSA and is growing quickly. You can see that the median income of seniors, 85 and older, varies greatly across the market, and so does the median home value for the market. When we look at median net worth and median home value together, we can see that there is also variation amongst the type of asset wealth that seniors have.

There are a number of other statistics that can, and arguably should, be accounted for when qualifying demand, such as home value, home ownership rates, and market-specific cost of living, just to name a few. At a minimum, we should be considering the net-worth of seniors, along with income, to obtain an accurate understanding of prospective markets. By qualifying demand solely on income, we are limiting our opportunity to a few primary markets. Sure, this has worked successfully for some, but as the industry continues to grow and competition intensifies, we will need to see the world through a different lens in order to continue to grow.