Senior Housing Industry Forecast: What to Expect in 2025 and Beyond

The senior housing industry is undergoing significant transformations due to factors such as increased demand for specialized senior care services and advancements in technology and healthcare. As we approach 2025, it’s crucial to understand the forecasted trends and challenges that will shape the landscape of senior housing in the coming years. NIC MAP’s report – Senior Housing Market Outlook highlights a positive outlook across near, medium, and long-term horizons, as the senior housing market is expected to evolve. Let’s take a closer look at some specific insights from NIC MAP’s data to better understand the status of this industry moving into 2025.

A Brief Look at the Past 4 Years

The senior housing sector has faced substantial challenges over the past four years but has proven its resilience in the face of adversity. The industry experienced a series of pandemic-induced shocks, starting with an occupancy and labor crisis due to the COVID-19 pandemic.

As the industry moved past the COVID-19 pandemic, supply and demand metrics began to recover. According to NIC MAP data, by the time Q1 2024 rolled around, occupancy and aggregate employment levels were within 1-2% of pre-COVID levels. Additionally, positive signs in the capital markets started to emerge as the Federal Reserve hinted at a coming rate-cutting cycle.

In the first quarter of 2024, the absorption rate in the senior housing sector increased by a staggering 40% compared to the previous year. This growth trend indicates a positive outlook for the industry, with demand continuing to outpace supply. Overall, the senior housing market has proven its resilience and ability to adapt to challenging circumstances, positioning itself for continued growth and success in the years to come.

The Impact of Rapid Senior Population Growth

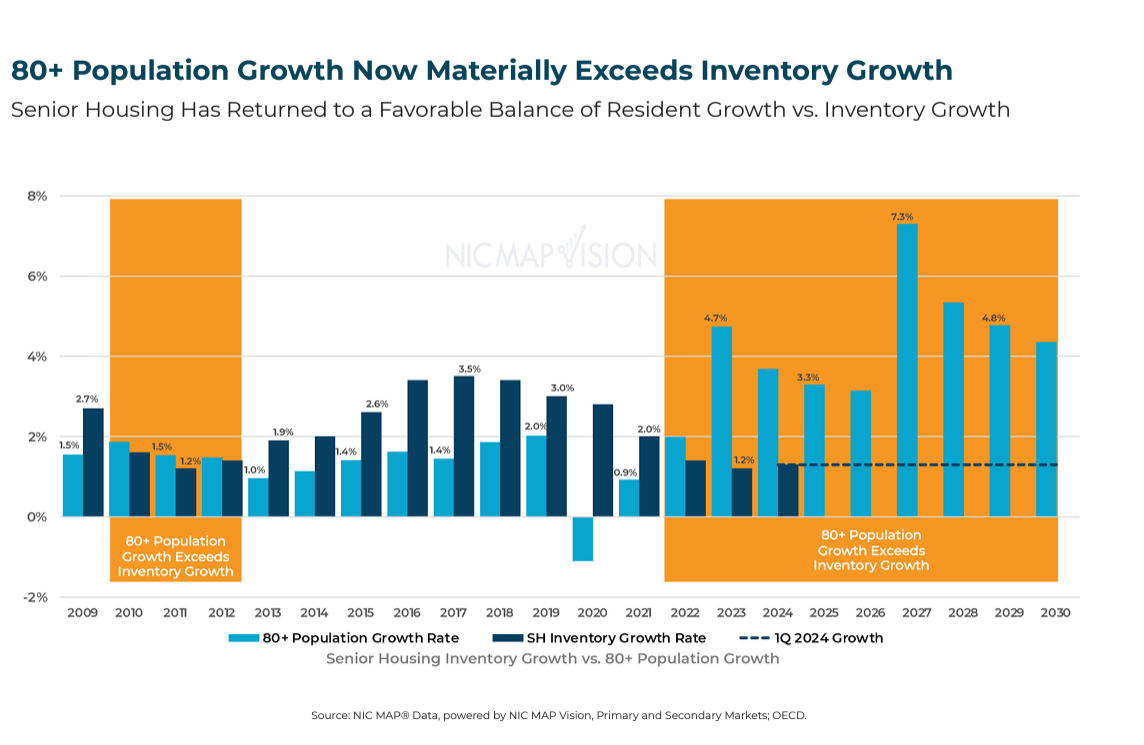

As the pandemic recedes into the distance, there has been a historic demand growth for senior housing, leading to a rapid occupancy recovery. This demand growth is occurring at a time when the 80+ population is beginning to outpace inventory growth, creating a growing gap between supply and demand in the industry.

From 2013 to 2021, per data from NIC MAP’s report, the supply growth in the senior housing sector had exceeded demand growth, resulting in gradually declining occupancy rates. However, beginning in 2022, the relationship inverted, with the 80+ population growth surpassing inventory growth. By 2023, the 80+ population growth began to materially outpace demand, highlighting the need for the industry to expand rapidly to meet the needs of this growing demographic.

Understanding this emerging trend is vital for senior housing operators, developers, investors to adapt their strategies and investments to capitalize on the increasing demand and ensure the sustainability and growth of the sector.

Key Implications for Investors and Lenders

Investors and lenders in the senior housing industry in 2025 are faced with both challenges and opportunities. The key implication for investors is that despite the challenges of compounded rate increases over the last three years, market demand for senior housing has not only persisted but flourished. Data from the report indicates historic highs in absorption rates underscores the strong consumer need for senior housing communities, presenting a promising outlook for investors looking to capitalize on this growing market.

As occupancy rates continue to rise and the post-pandemic normalization of the labor market drives favorable rent/expense growth dynamics, industry financial health indicators are expected to improve significantly.

Important Insights to Consider for 2025 & Beyond

The complete Senior Housing Market Outlook report is available for download, but we want to share a few senior housing trends that highlight the significance of this resource:

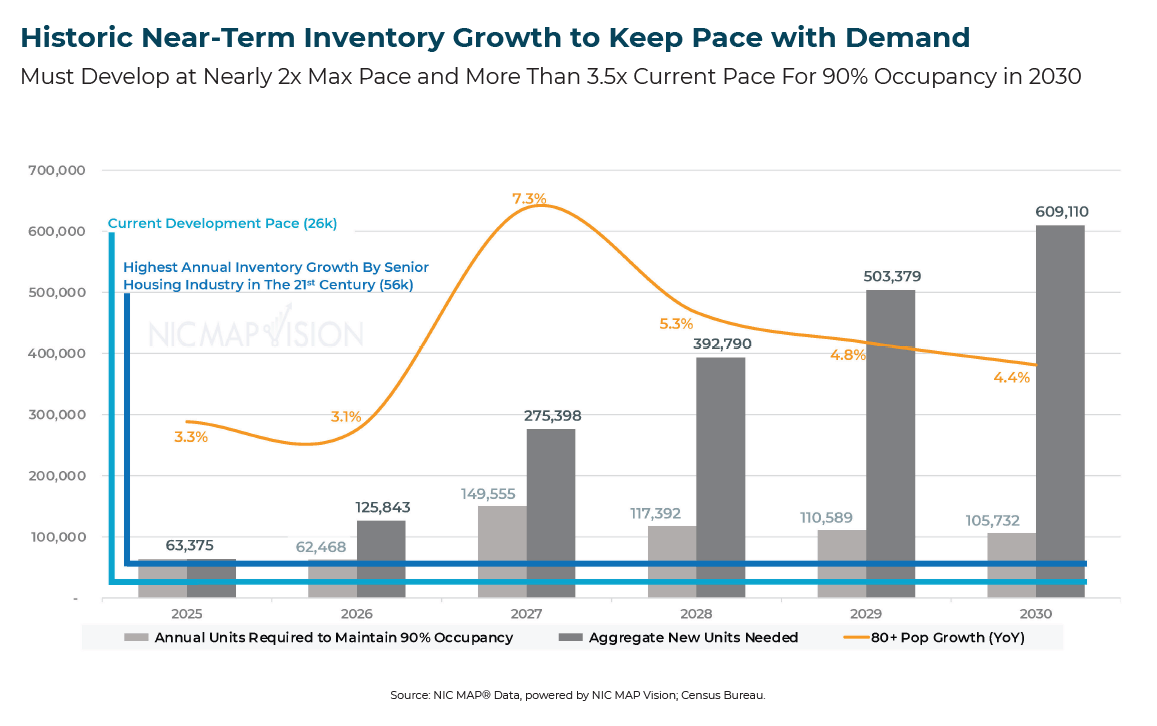

Clear Indications of the Need for New Development

The clear need for new senior housing development is evident as demand growth accelerates rapidly. Meeting this demand is crucial for those who wish to position themselves advantageously in the market. Both Census and Claritas data also indicate the aging population wave is set to reach its peak in the latter part of the 2020s, signaling the urgent need for an increase in senior housing options.

Increased Household Income

The financial outlook for households aged 65 and over, as well as those aged 75 and over, appears promising, with data from NIC MAP’s report indicating a significant rise in median net worth and income levels over the past decade. This positive trend suggests that seniors will have more financial resources at their disposal, enhancing their ability to afford senior housing options with cost having less of an impact.

Opportunities Abound

The data from NIC MAP demonstrates that the senior housing industry presents significant opportunities for investors, developers, and vendors due to the continuous demand for quality senior care, even in times of financial pressure. With a robust and durable demand for senior housing, consumers perceive it as a necessary and valuable investment, making it an attractive sector for stakeholders. Our report highlights the potential for growth in this sector, especially with projections of a $275 billion supply gap by 2030 if the development pace does not increase.

This information suggests that senior housing is not only a sound financial investment but also a valuable and necessary service for an aging population. As a result, stakeholders in this sector are likely to see positive returns on their investments.

Go More In-Depth with the Senior Housing Market Outlook Report

As we look ahead to 2025 and beyond, the senior housing industry is poised for continued growth and success. With the seniors population rapidly growing and outpacing inventory growth, there is a clear need for the industry to expand to meet the needs of this demographic.

Investors and lenders have the opportunity to capitalize on this growing market, as historic highs in absorption rates demonstrate strong consumer demand for senior housing communities. As the industry navigates the changing landscape, the forecasted trends suggest a positive outlook for senior housing in the years to come.

Explore Further with the Senior Housing Market Outlook Report