Skilled Nursing Occupancy Reached New Low In November 2020

February 10, 2021

Medicaid Revenue Per Patient Day Up But Cost of Care Still a Concern.

NIC MAP® Data Service released its latest Skilled Nursing Monthly Report on February 4, 2021, which includes key monthly data points from January 2012 through November 2020.

Here are some key takeaways from the report:

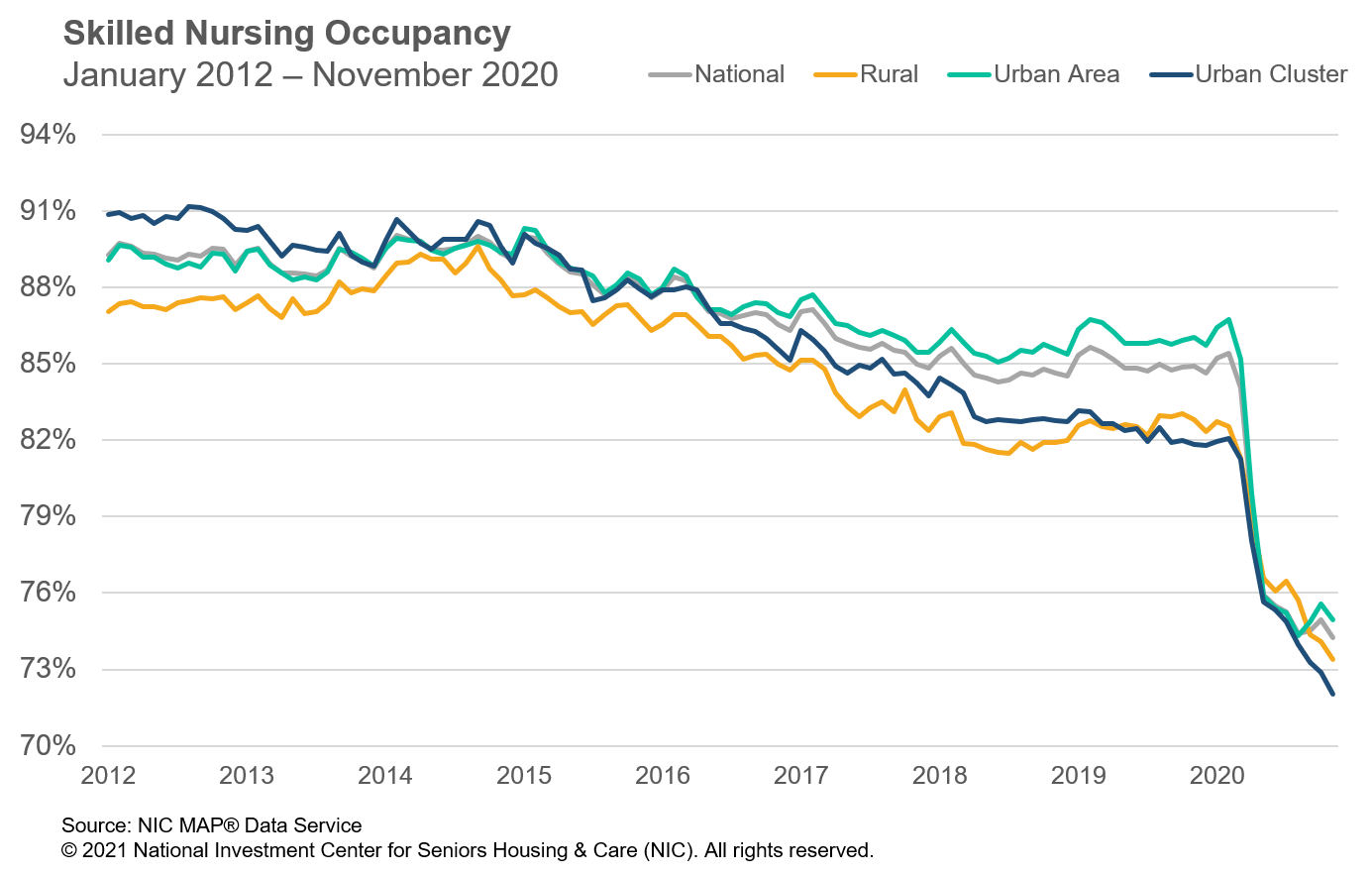

Occupancy

Occupancy continues to be challenged for skilled nursing properties, with the November 2020 occupancy rate falling to a new low of 74.2%. It was down 69 basis points from October (74.9%) and 11.2 percentage points from pre-pandemic levels in February 2020 (85.4%) and 10.7 percentage points from year-earlier levels. Since February 2020, COVID-19 has significantly impacted skilled nursing operations across the country due to high acuity levels of residents, pandemic-related deaths as well as fewer elective surgeries at hospitals which have resulted in less need for rehab services often provided by nursing care properties. As the country and the skilled nursing sector navigate through the Winter months and vaccine distributions, it is likely that occupancy will continue to face pressure.

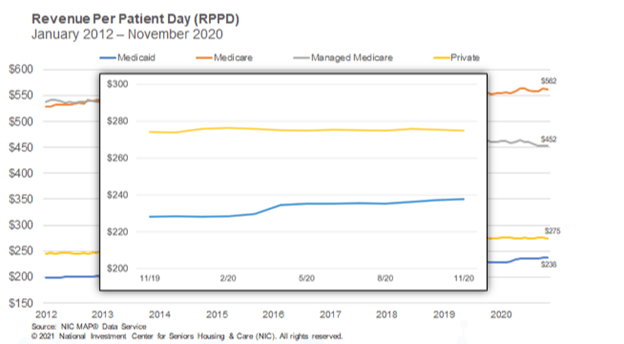

Medicare

Medicare revenue per patient day (RPPD) was unchanged at $562 from October to November 2020. However, it is up by 1.6% since March. This increase is likely because of additional reimbursement by Medicare for COVID-19 positive patients requiring isolation, in addition to the temporary suspension of the 2.0% sequestration cuts by the Centers for Medicare and Medicaid Services (CMS). In addition, Medicare RPPD increased 1.7% compared to a year ago. Meanwhile, Medicare revenue mix increased 80 basis points from October to end November at 22.2%. It has increased 141 basis points since April.

Managed Medicare

Managed Medicare RPPD hit a time-series low (since 2012) as it decreased once again from the prior month. It ended November 2020 at $452. Early in the pandemic managed Medicare RPPD increased but has resumed the years-long trend of monthly declines. It is down 2.0% since November 2019 and has declined 16% ($86) since January 2012, Meanwhile, managed Medicare revenue mix decreased 36 basis points from October to November to 8.8%. However, it has declined 208 basis points since February, when it was 10.9% before the pandemic started.

Medicaid

The relatively large increases in Medicaid RPPD seen at the onset of the pandemic have slowed, especially after the 2.1% increase experienced in April. Early in the pandemic, initial increases in reimbursement from some states helped skilled nursing properties related to the number of COVD-19 cases at properties. In November, RPPD increased 0.2% from October, ending at $238. On a slightly longer time frame, Medicaid RPPD is up 4.2% from the prior year. However, even with this increase, the concern continues to be that current Medicaid RPPD does not cover the actual cost of care in most states.

To get more trends from the latest data you can download the Skilled Nursing Monthly Report here. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form here. NIC maintains strict confidentiality of all data it receives.

About Bill Kauffman

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.