Surge in Skilled Nursing COVID Cases, Staffing Shortages Worsening

January 17, 2022

Weekly virus cases among residents and staff within skilled nursing facilities (SNFs) had been somewhat steady since the vaccine rollout in December 2020. However, the fast-spreading omicron variant has changed the narrative once again and prompted worries around worsening staffing shortages. SNFs are once again faced with rising COVID-19 cases among both residents and staff on top of a reportedly bad flu season compared with 2020.

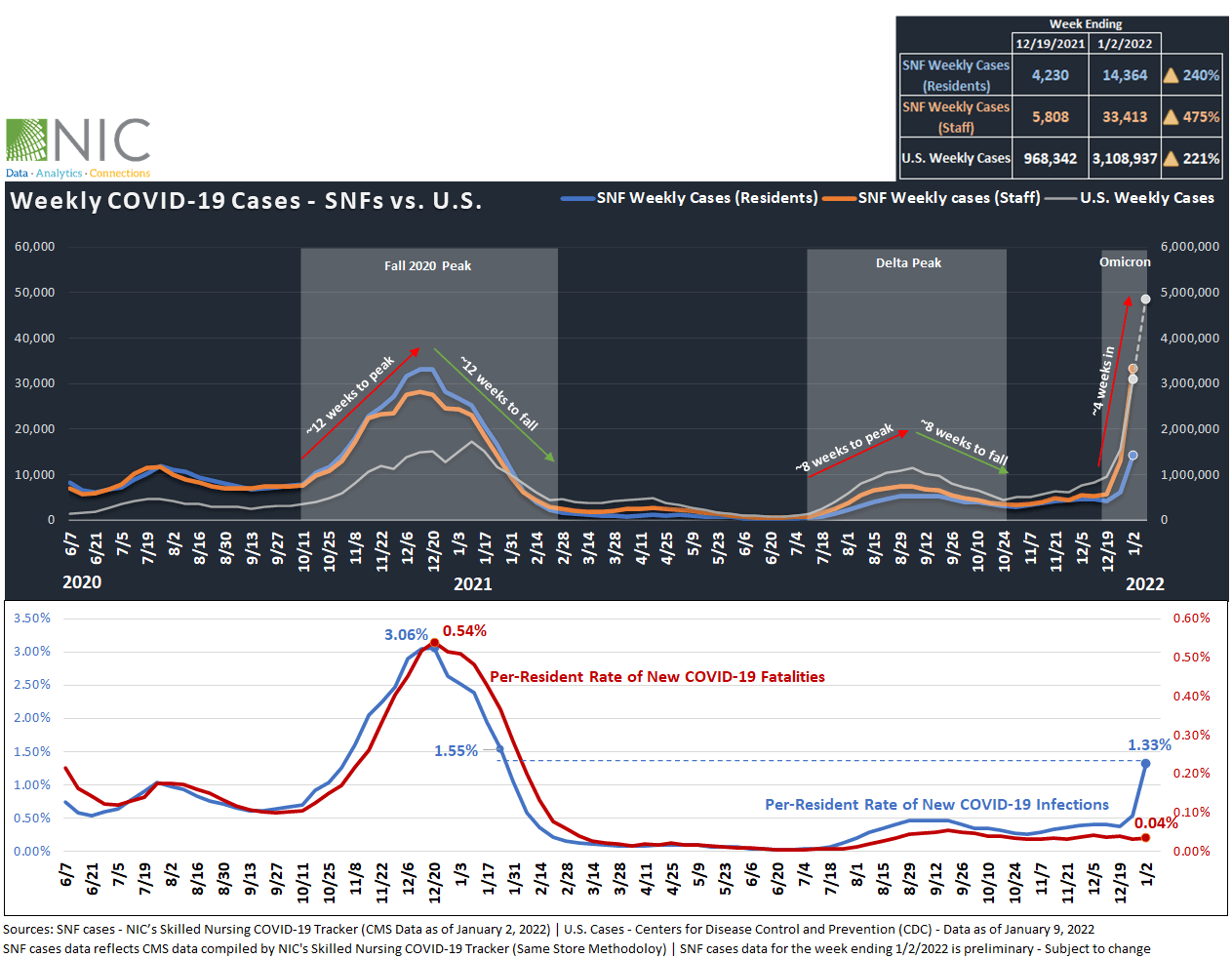

Weekly Cases Within SNFs Rising at Fastest Rate Ever. Fatalities Remain Relatively Low.

SNFs – NIC’s Skilled Nursing COVID-19 Tracker featuring CMS data as of January 2, 2022, shows that weekly COVID-19 cases within SNFs are rising steeply. Virus cases among staff jumped 475%, from about 5,800 on December 19, 2021, to over 33,400 new cases on January 2, 2022, the highest rate since CMS began reporting data in June 2020. The CDC Nursing Home COVID-19 Dashboard shows that weekly COVID-19 cases among staff set a new record for the week ending January 9, 2022 with over 57,000 new cases, double the peak of fall 2020 cases for COVID-19 (roughly 29,000 reported cases on December 13, 2020).

Over the same period, weekly cases among residents increased dramatically by 240%, from over 4,200 on December 19, 2020, to about 14,400 new cases on January 2, 2022. At the same time, the per-resident rate of new COVID-19 infections rose to 1.33% (133 in 10,000 residents tested positive on January 2) and surpassed levels seen at the height of the Delta variant in September 2021 (0.47%). Per resident rate of new COVID-19 infections is now at levels seen one year ago (1.55% of residents tested positive on January 24, 2021). Newly confirmed cases among residents continued to climb higher through the week ending January 9, 2022, with over 32,000 reported cases.

Regionally – SNFs in the Northeast region reported the highest per-resident rate of new COVID-19 infections at 1.64%, followed by the South (1.43%), the Midwest (1.39%), then the West (0.49%), according to CMS data as of January 2, 2022, compiled by NIC’s Skilled Nursing COVID-19 Tracker. Further, 24% of U.S. SNFs reported newly confirmed cases among residents for the week ending January 2, 2022, nearly three times the share of facilities recorded on December 19, 2021, of 9%.

U.S. – Similarly, weekly cases among the general population rose by 221%, from 968,000 on December 19, 2021, to over 3.1 million cases on January 2, 2022. Weekly cases among the general population continued to rise higher through the week ending January 9 to set new records with 4.9 million cases, averaging about 700,000 new cases daily and nearly triple the peak of January 2021 (U.S. COVID-19 cases topped 1.7 million for the week ending January 10, 2021), according to CDC data compiled by NIC’s Skilled Nursing COVID-19 Tracker.

Fatalities (SNFs) – While the spread of the omicron variant pushed cases off the charts, fatalities among SNF resident remain relatively low. Notably, the per-resident rate of new COVID-19 fatalities averaged about 0.03% weekly since March of 2021 (3 in 10,000 residents died from COVID-19 weekly since March 2021) when most residents and staff in SNFs were vaccinated. For the week ending January 2, 2022, fatalities as percent of residents stood at 0.04%, 50 basis points below the highest level recorded on December 20, 2021 (0.54%).

Other Countries – Interestingly, COVID-19 data from other countries where Omicron has reached its peak, such as the U.K., show that fatalities associated with the Omicron variant are five times fewer than during the Fall 2020 wave. The big disconnect between infections and fatalities in the U.K. reveal an optimistic signal for the U.S. that the Omicron variant may not be as fatal.

Prior Waves – Exhibit 1 below shows that during the fall 2020 wave prior to widespread vaccinations, infections in the country and within SNFs peaked and then fell at the same pace. In other words, it took approximately 12 weeks for recorded cases to peak and a subsequent 12 weeks to decline. Similarly, the Delta variant surge took about eight weeks to peak and eight weeks to decline. The Omicron wave in the U.S. has thus far had a duration of about five weeks, but the data do not yet reveal a trend reversal indicator. However, infections in the U.S. and within SNFs will likely follow the same trajectory as the U.K. and fall at the same pace from which they peaked. In fact, COVID-19 cases in the U.K. are falling very fast and at the same pace in which they peaked.

Since December 2020, vaccinations have made a significant contribution to mitigate the risk of severe illness and fatalities among skilled nursing residents, even during the Delta variant surge in recent months. However, it is still important to realize that skilled nursing facilities need vaccinations in combination with other interventions, including more frequent testing, physical distancing, and adherence to masking guidelines. These interventions continue to be an effective and vital tool to limit the spread of both current Omicron variant and flu cases among residents and staff until cases in the country decline and return to lower levels and until booster shots are more widely distributed.

Exhibit 1 – Weekly COVID-19 Cases (SNFs vs. U.S.) and Fatalities Among SNF Residents

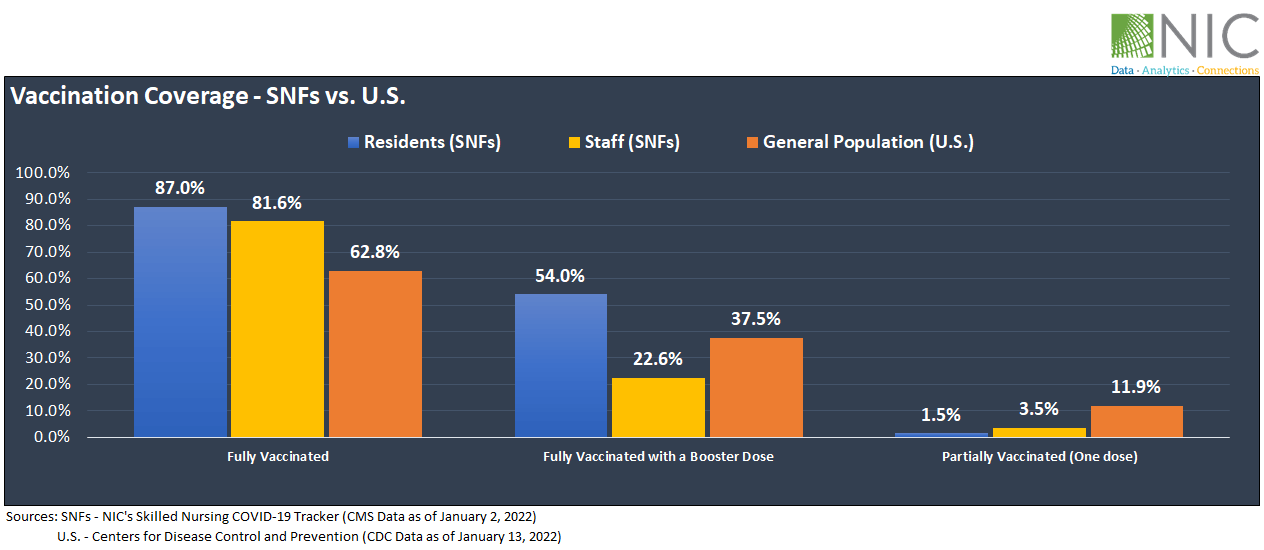

Vaccinations and Boosters (SNFs vs. U.S.)

Exhibit 2 below shows that as of January 2, 2022, 87.0% of residents within SNFs have been fully vaccinated, 54% of residents received a COVID-19 vaccine booster and 1.5% have been partially vaccinated, according to CMS data compiled by NIC’s Skilled Nursing COVID-19 Tracker.

For staff, 81.6% have been fully vaccinated. Unfortunately, staff booster shots are lagging behind, with only 22.6% of staff having received a COVID-19 vaccine booster, 31 percentage points below the rate of residents (54%) who received a vaccine booster. Additionally, 3.5% of staff are partially vaccinated.

More broadly, at the national level, only 62.8% of Americans have been fully vaccinated, 37.5% of fully vaccinated Americans received a booster shot, and 11.9% are partially vaccinated, as of January 13, 2022, according to CDC data.

Exhibit 2 – Vaccination Coverage (SNFs vs. U.S.)

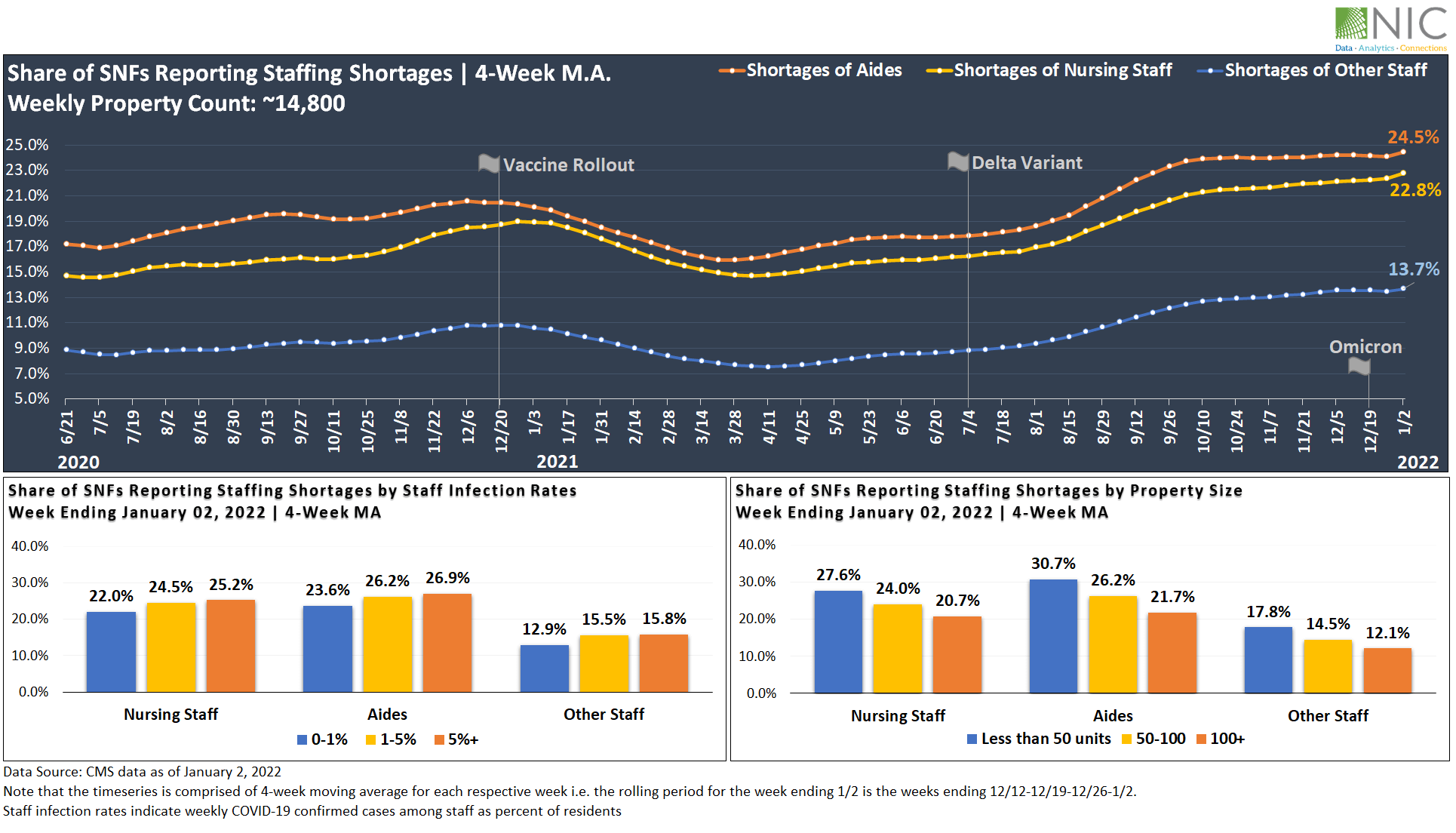

Staffing Shortages Could Get Much Worse and Impact the Near-term Outlook

The impact of staffing shortages on limiting admissions has become evident in recent months, with anecdotal stories of more and more facilities reportedly being concerned about having to limit admissions or temporarily close due to workforce challenges. These labor supply constraints will further challenge the sector’s demand recovery and may impact the near-term outlook for occupancy.

Exhibit 3 below depicts the share of SNFs reporting staffing shortages. For the week ending January 2, 2022, 24.5% of SNFs reported shortages of aides, 22.8% reported shortages of nursing staff, and 13.7% reported shortages of other staff, according to CMS data compiled by NIC’s Skilled Nursing COVID-19 Tracker.

Additionally, the charts below show that high infection rates among staff are driving staffing shortages up within skilled nursing facilities. For example, the largest shares of facilities reporting staffing shortages among hands-on essential workers (aides and nursing staff) are among facilities with high staff infection rates (5%+). Among this cohort, 26.9% of facilities reported shortages of aides and 25.2% reported shortages of nursing staff. Facilities with low infection rates among staff (0-1%) are reporting relatively smaller shares with 23.6% of facilities reporting shortages of aides and 22.0% reporting shortages of nursing staff. The same pattern holds for other staff (15.8% vs. 12.9%).

Drilling deeper into the data by property size, the largest shares of skilled nursing facilities reporting staffing shortages were among small facilities (less than 50 units) with 30.7% reporting shortages of aides, 27.6% reporting shortages of nursing staff, and 17.8% reporting shortages of other staff, while large facilities (100+ units) were reporting the smallest share of facilities experiencing staffing shortages among aides (21.7%), nursing staff (20.7%) and other staff (12.1%). This suggests that small facilities may be facing heightened recruiting and retention challenges than large facilities.

Exhibit 3 – Share of SNFs Reporting Staffing Shortages – By Staff Infection Rates and Property Size

Staffing shortages will likely persist in 2022 and attrition rates may get worse in the near term due to rising infections. The prolonged levels of anxiety and grief that workers have experienced during the pandemic, must be influencing workers’ decisions on staying in place at their current jobs. Nationally, the quit rate among all workers is at a record high, according to the November 2021 JOLTS survey conducted by the BLS.

Improving workers’ experience and building strong staff-resident relationships will be critically important in 2022. Further, maintaining consistency with nursing staff and aides is crucial for the well-being of both residents and staff. High tenure workers tend to have strong relationships with residents and patients, which in turn leads to excellent health and custodial care services for the patient and better job satisfaction for workers.

The staff-resident relationship within the skilled nursing sector is much stronger than the staff-patient rapport in hospitals, simply because the SNFs residents’ length of stay is much longer. This nurse-resident relationship is unparalleled and could serve as a competitive edge to attract and retain workers in skilled nursing facilities.

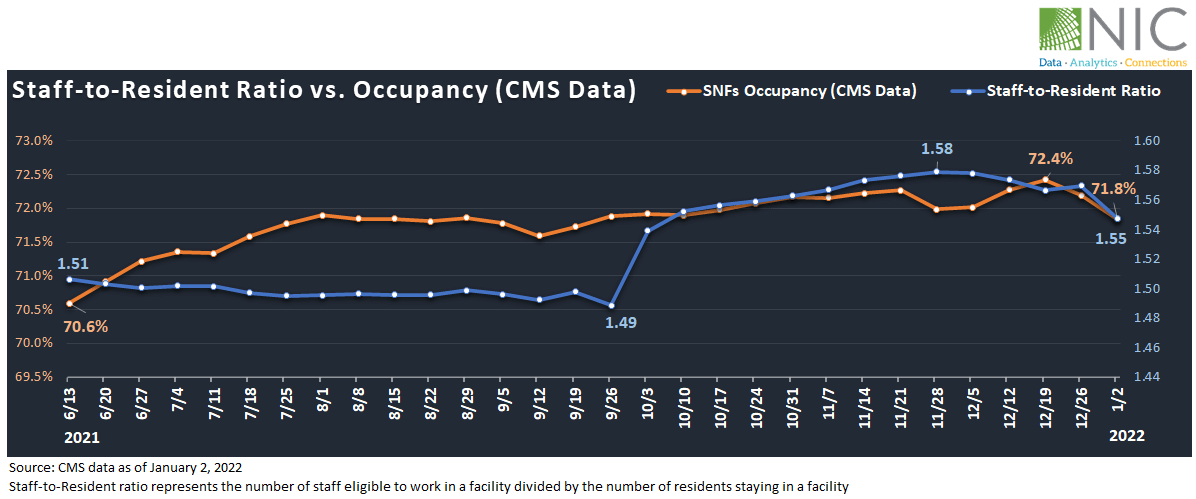

Staff-to-Resident Ratio vs. Occupancy (CMS)

Exhibit 4 below shows that since June 2021, occupancy (based on CMS data) has been steadily improving. Notably, occupancy increased by 1.8 percentage points, from 70.6% on June 13, 2021, to 72.4% on December 19, 2021. The staff-to-resident ratio has also increased from 1.51 on June 13 to 1.58 on November 28.

However, in the past two weeks following the surge in cases within SNFs, occupancy fell by 0.6 percentage points, from 72.4% on December 19 to 71.8% on January 2, 2022. The staff-to-resident ratio took a downward trend and is now at 1.55.

The staff-to-resident ratio and occupancy will likely continue to fall in the next few weeks due to rising cases further exacerbating staffing challenges and limiting new admissions. However, as Omicron fades away and cases move back to normal levels, these metrics should begin to balance out.

Exhibit 4 – Staff-to-Resident Ratio vs. Occupancy (CMS Data)

To gain in-depth insights and track vaccination coverage, U.S. weekly cases, and the week-over-week change rate for new resident cases and fatalities of COVID-19 within skilled nursing facilities at the state and county levels, visit NIC.org.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.