The Impending Age Wave : Navigating the Urgent Need for Senior Housing

As Baby Boomers enter their retirement years and beyond, the country’s aging population is rapidly expanding.

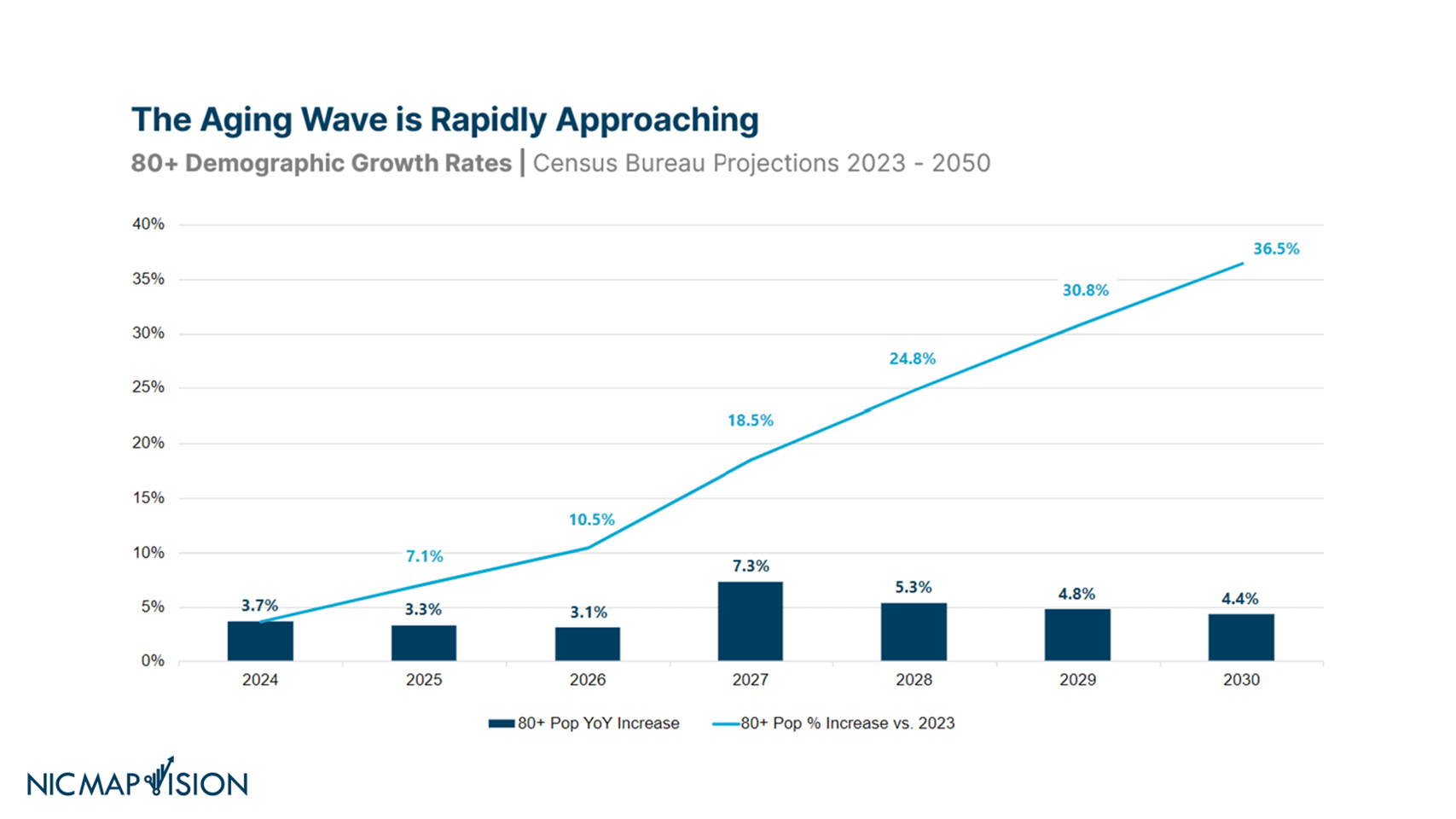

For those in the senior housing market, this signals an impending ‘age wave’ or ‘boom’ in demand that requires everyone’s attention. There’s a demographic shift on the horizon as the 80+ age group is projected to expand significantly between 2023 and 2030.

This burgeoning population necessitates something important: The parallel increase in senior housing inventory that’s needed to meet escalating demand. In this post, we explore the urgent need for strategic planning and development to ensure that the housing needs of our seniors are met adequately and timely.

The Aging Wave: A Rapid Surge

The indicate a swift and substantial increase in the population aged 80 and above. Case in point: The 80+ population is set to increase by 3.7% in the next year alone. But next year is certainly no outlier in this upward trend. The growth of the senior population will increase from this year’s figures, growing by 12% by 2025, almost 25% by 2027, and over 40% by 2030. What we can gather from these statistics is that the ‘aging wave’ is not just a distant future scenario—this wave is rapidly approaching, and its impact will be felt across the entire senior living industry. In fact, the growth rate of this demographic is predicted to outpace every other age group, highlighting an urgent need to prepare for the inevitable surge in demand for senior housing and care facilities.

It’s important to note, however, that the aging population is not just growing; it’s also evolving. Today’s seniors are living longer and healthier lives than the generations before them.. Alongside this positive trend though, there is an increase in care and acuity needs. Chronic conditions and age-related ailments necessitate specialized care, and as these needs rise, the traditional support systems will also change.

In years and generations past, adult children or spouses often shouldered the responsibility of caregiving for older loved ones. However, modern societal dynamics, including smaller family sizes and increased geographic mobility, mean that there are fewer caregivers available within families. This shift underscores the need for congregate care environments that can provide seniors with the support and community they require.

These settings can offer seniors a sense of community, social engagement, and necessary care services, all under one roof. The industry must, therefore, focus on creating environments that are not just residences but holistic communities that prioritize health, well-being, and social connectedness.

Within these communities, balancing affordability with quality becomes paramount—especially given this generation’s longer lifespans and potential for increased healthcare needs.

Inventory Challenges: Keeping Pace with Demand

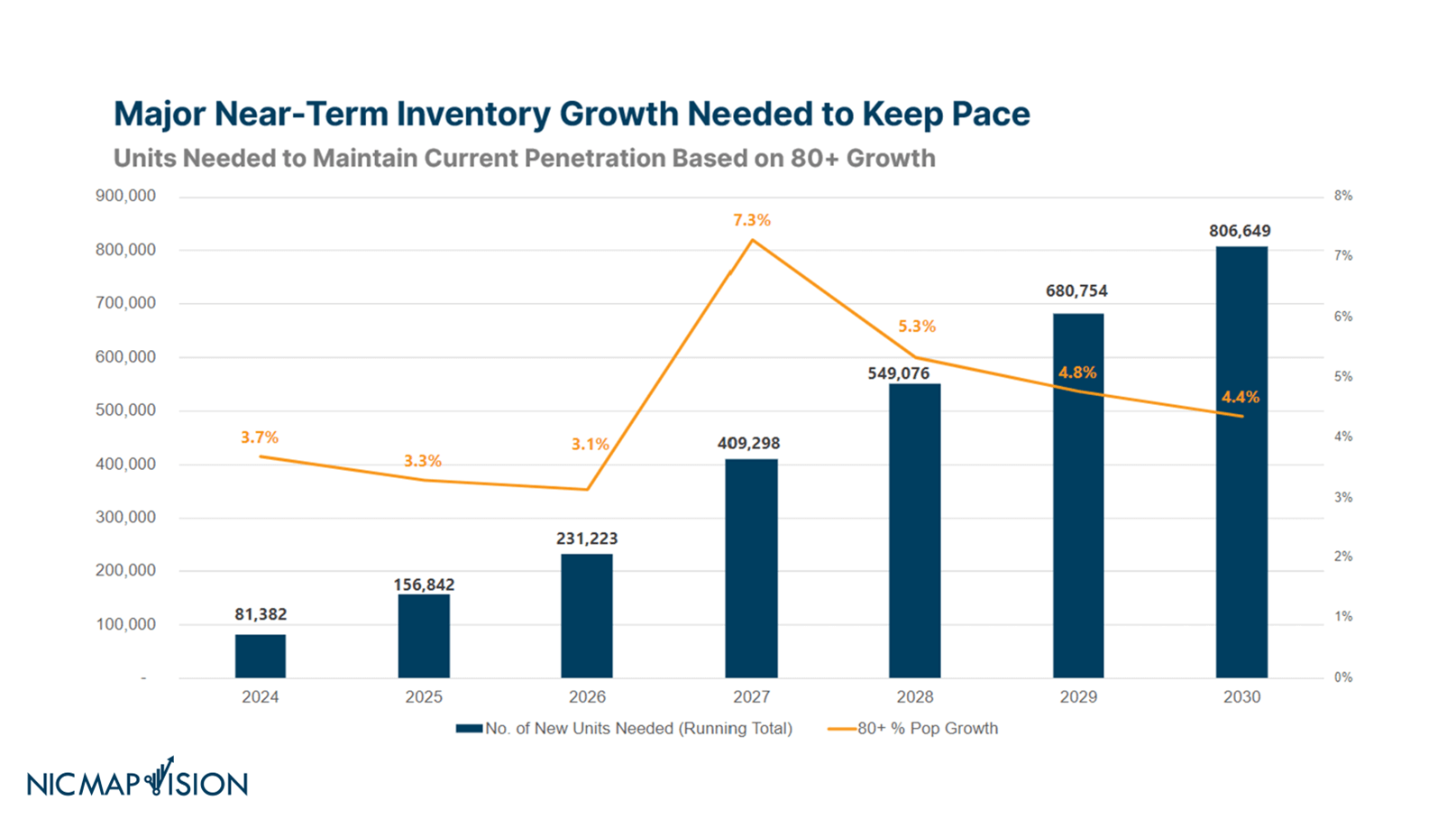

To maintain the current market penetration rates in the senior housing sector, substantial near-term growth in housing inventory is imperative.

It is important to note, however, that simply ‘maintaining’ the current market penetration rates in anticipation of an aging population may not be enough. In other words, keeping up with the current penetration rates as developers plan to meet future needs is only a conservative estimate. This is because the ratio of the senior population (age 80+) to the adult child or caregiver population (age 45-64) is expected to continue to narrow as the boomer generation ages into senior status.

However, just to maintain current penetration rates, NIC MAP data predicts a need for over 200,000 additional senior housing units by 2025, 500,000 additional units by 2028, and 775,000 additional units by 2030.

Why is this matter so pressing? The senior housing industry is currently in a period of decline for new construction starts. In 2023 alone, there will have been an estimated 5,000 new units under construction per quarter. Even when this construction cycle inevitably accelerates, it may not be fast enough to keep up with growing demand. This is because senior housing projects take one to two years to complete from groundbreaking, placing the arrival of future units far behind the anticipated demand.

In a scenario where the senior housing supply falls short of demand, seniors may find themselves navigating a landscape with limited housing options. This can potentially mean many seniors will have to make unwanted compromises when it comes to the quality or location of their new housing. Furthermore, scarcity can lead to increased costs, making senior housing unaffordable for many who need the safety, community, and well-being it provides.

The $300 Billion Gap: A Call for Action

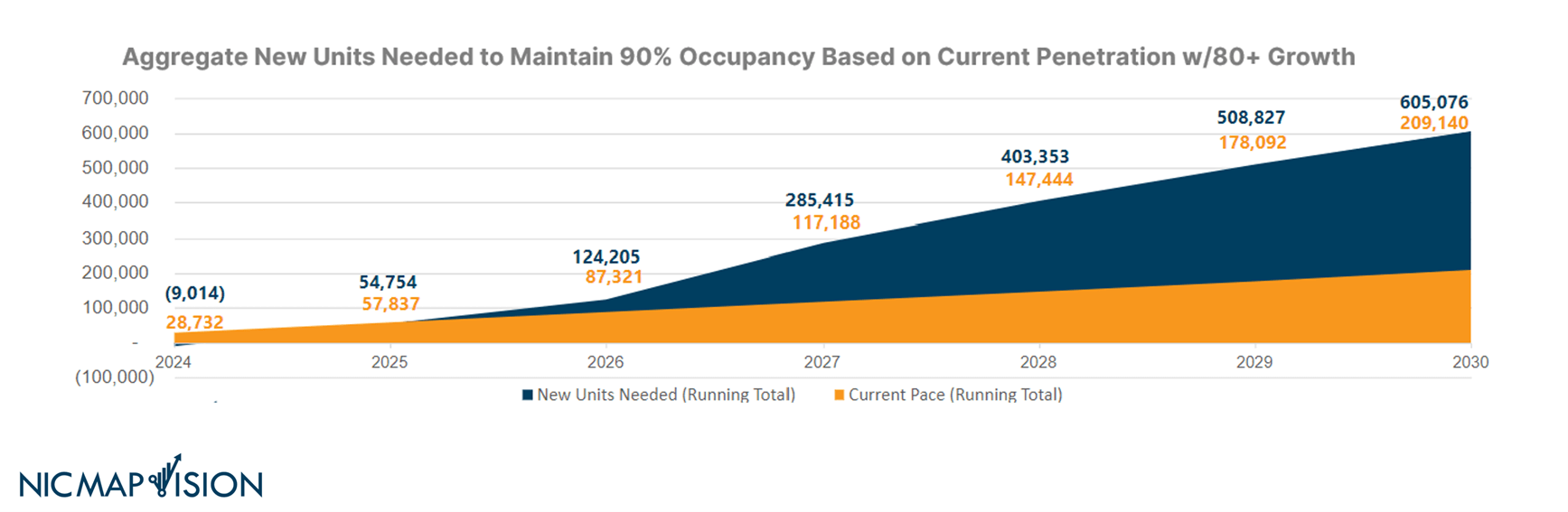

The above graphic illuminates one of the most pressing concerns within the senior housing industry. That is, the significant gap between the current pace of development and the pace required to meet the burgeoning demand driven by the growth of the 80+ demographic.

In this context, the graphic presents a stark picture of the industry’s current trajectory. The development of new senior housing units is certainly underway, but the pace at which these projects are being completed falls significantly short of what’s required to accommodate the rapidly growing population of seniors.

The gap shown can be visualized as a chasm between two cliffs. On one side, we have the current development pace, moving steadily but perhaps too slowly, attempting to construct new units and facilities for seniors. On the opposite cliff, we see the relentless march of time and demographic change, with the 80+ age group growing at a pace that outstrips the current rate of housing development. This gap represents a potential $300 billion shortfall by 2030.

It signals a future where many seniors might find themselves without suitable housing, where the demand far outpaces supply, leading to potential difficulties in affordability, accessibility, and quality of care. To bridge this chasm, the industry must significantly accelerate its development efforts.

The $1 Trillion Requirement: Ensuring Housing for All Seniors

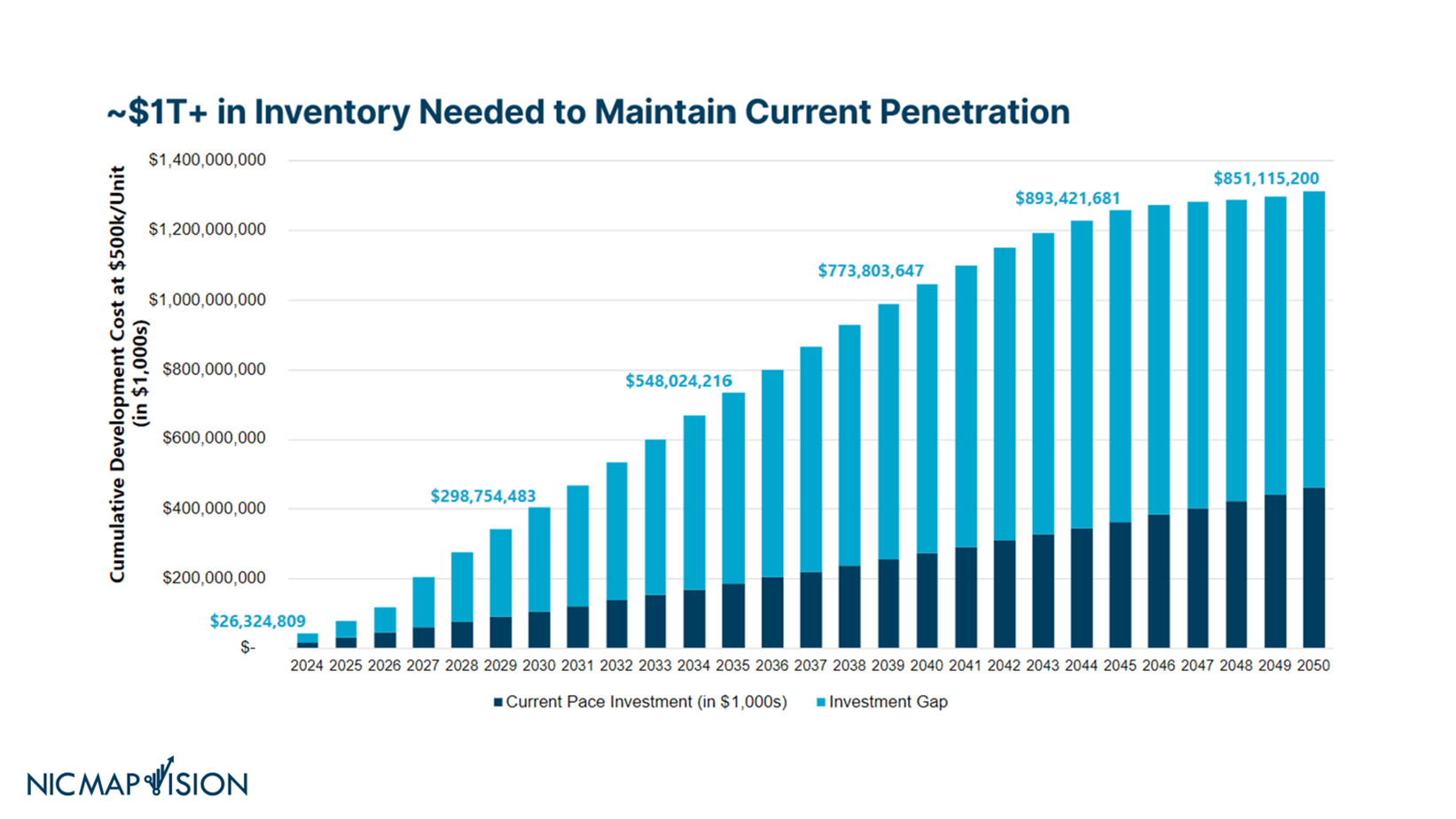

This graphic brings into focus another critical aspect of the senior housing industry: The widening gap between the current investment pace and the level of investment required to meet the growing demand from an aging population.

What we see is an escalating investment requirement in the senior housing sector. By 2030, an industry-wide investment of $400 billion will be needed to complete the required new development to meet the anticipated demand. However, it is estimated that only 40% of that investment need is currently on-pace to be fulfilled.

And this issue will only get worse as the population boom continues. By 2040, it’s estimated that the current investment pace will barely exceed a quarter of the required investment need.

But there is good news too. Investments in senior housing are indeed increasing. Stakeholders are recognizing the potential of (and the necessity for) serving this aging demographic.

Even so, as we can see from the data displayed in the graph, despite the increase in investments, the gap between the current investment pace and the required investment pace is widening.

In essence, while we are moving in the right direction, we are not moving fast enough. The required investment to maintain the current market penetration rates is estimated to be over $1 trillion, the majority of which is not estimated to be met.

Navigating the Future

As we reflect on the coming demographic shift and its profound implications for the senior housing industry, there’s an undeniable sense of optimism coupled with a drastic sense of urgency. The rapid growth of the population aged 80 and above is a testament to advancements in healthcare and quality of life, and it brings with it a robust and burgeoning demand for senior housing.

This strong demand presents a golden opportunity for stakeholders in the senior housing industry. There is potential for growth, innovation, and the development of communities that are not just residences but real, all-encompassing communities that cater to the diverse needs of seniors. From advancements in healthcare technology to the development of sustainable and engaging living spaces, the possibilities are boundless.

But take note: This optimism is accompanied by a call to action. The widening gap between the current pace of investment and development and the required pace to meet the surging demand underscores the urgency of the situation. The industry faces a substantial investment requirement, with the need to bridge that potential $1 trillion gap.

In conclusion, the future of the senior housing industry is bright. It is marked by strong demand and ample opportunities for positive impact. It is incumbent upon stakeholders — developers, investors, policymakers, and care providers — to rise to the occasion. By accelerating investments, fostering innovation, and strategically planning for the future, we can ensure that the growing demand is not just met but exceeded, crafting a future where our seniors live their golden years in comfort, community, and care.

The key to moving forward with confidence? Data-driven decisions powered by NIC MAP. Discover more by connecting with our team of experts today.