The Resurgence of Senior Housing

December 29, 2023

A Glimpse into Post-Pandemic Occupancy Recovery

The year 2020 marked an unprecedented time in history, with industries worldwide feeling the aftershocks of the pandemic. This included the senior housing and nursing care industry. With visitation restrictions, health concerns for residents and front-line employees, and the vulnerability of the senior demographic, many wondered: When would the senior housing sector bounce back to its pre-pandemic starting point?

The good news is that the senior housing market is making a confident recovery. Today, we delve into the current state of senior housing occupancy recovery, thanks to NIC MAP data that paints an optimistic picture for the near future.

Full Occupancy Recovery: On the Horizon

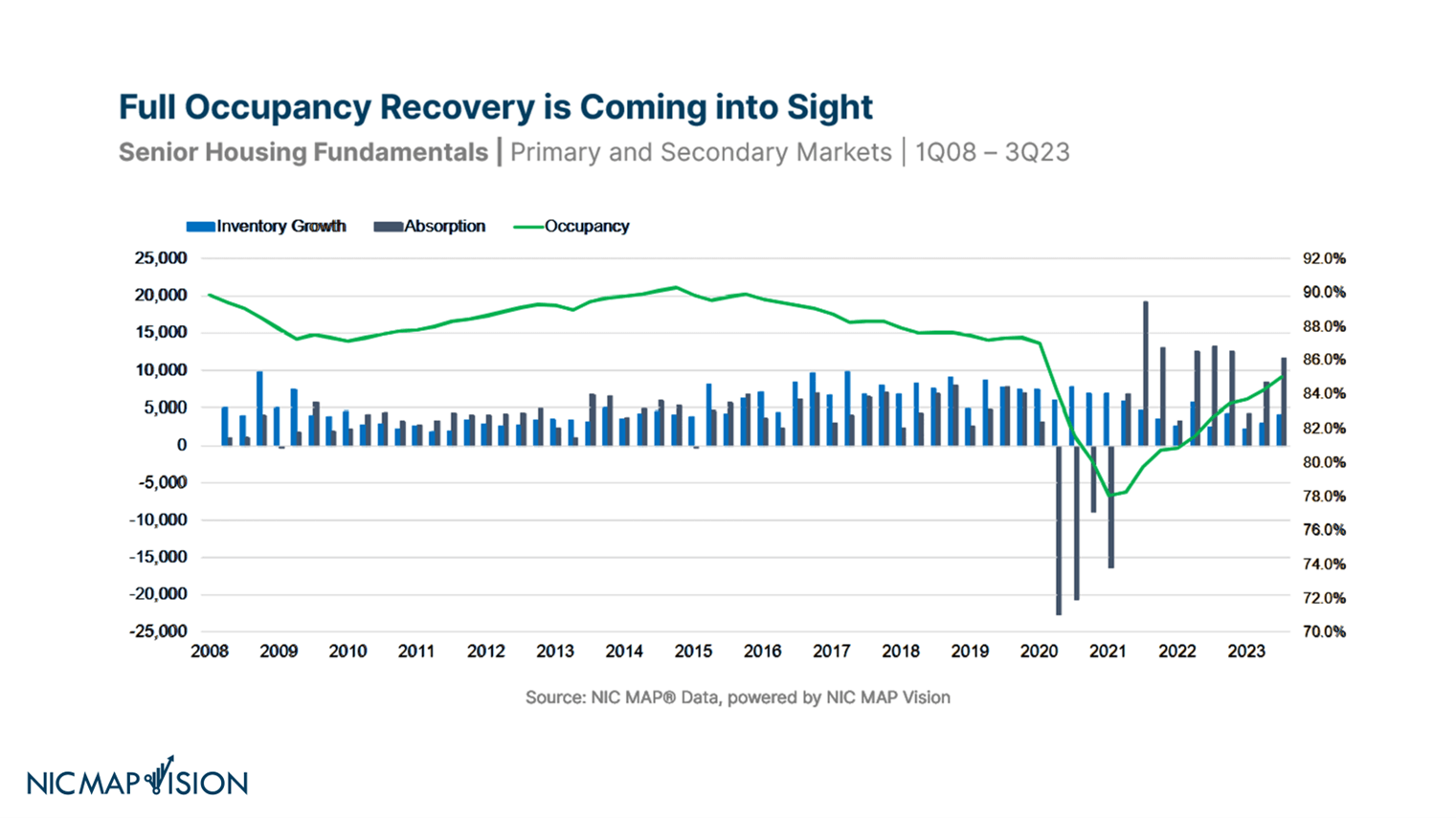

In the years leading up to 2020, the senior housing sector experienced consistent growth and stability. While the overall senior housing occupancy rate was in a slow state of decline from 2015 through 2019, much of this trend can be attributed to New Inventory outpacing Absorption. Absorption, or the demand for senior housing units, remained consistently strong in the years preceding the pandemic. However, once the pandemic hit, many facilities experienced a steeper decline in occupancy rates, resulting from negative absorption. In the first four quarters impacted by the pandemic, almost 70,000 fewer units were occupied across both Primary and Secondary markets. Over that same stretch, over 27,000 senior housing units opened.

As we now fast forward to 2023, this landscape seems to be shifting positively. Data suggests that full occupancy recovery is not just a distant dream, but rather an impending reality. Primary and secondary markets alike are experiencing this upward trend in similar ways, signaling the public’s renewed trust and confidence in senior housing establishments.

Following the early, challenging quarterly data, new data has demonstrated a strong recovery.. In fact, not only has the market experienced 10 consecutive quarters of positive absorption, but in every one of the last 10 quarters, the market has witnessed the rate of absorption outpace the rate of new inventory. Furthermore, the pace of recovery can be considered very strong at this point, as seven of the last 10 quarters have delivered the highest volume of absorption, or rather, the net change in occupied units, in the entire history of NIC MAP data collection!

A Milestone Achievement: Surpassing Pre-Pandemic Levels

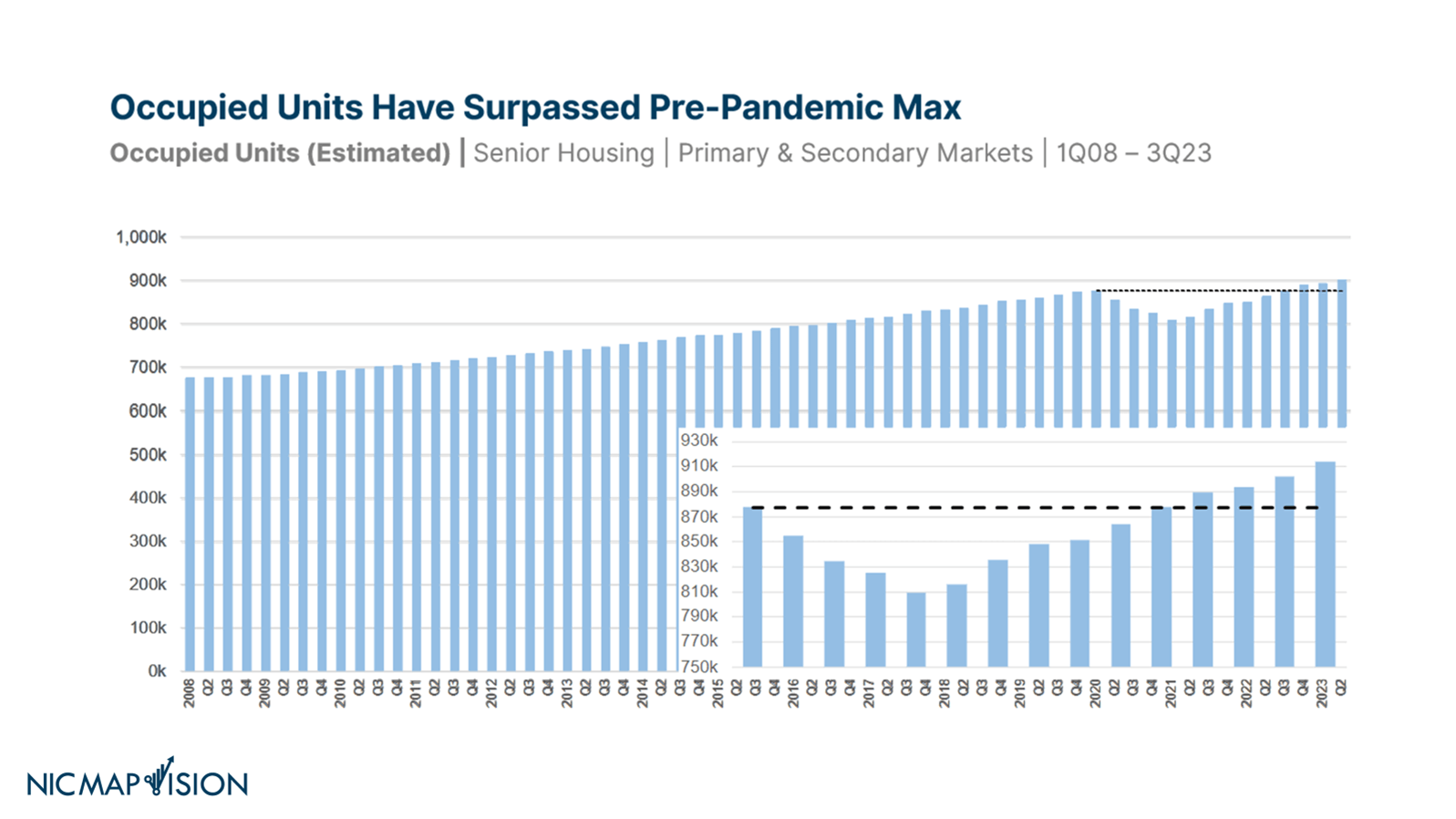

One of the most notable achievements in the current senior housing sector is the significant increase in occupied units. Recent findings from NIC MAP Vision show that the number of occupied units has not only returned to pre-pandemic numbers but surpassed them. While it may have taken 2 years to regain the number of occupied units lost in the first year of the pandemic, the industry has cleared that hurdle, with no signs of slowed growth anytime soon.

One of the most notable achievements in the current senior housing sector is the significant increase in occupied units. Recent findings from NIC MAP Vision show that the number of occupied units has not only returned to pre-pandemic numbers but surpassed them. While it may have taken 2 years to regain the number of occupied units lost in the first year of the pandemic, the industry has cleared that hurdle, with no signs of slowed growth anytime soon.

What’s more, since the start of 2021, the senior housing occupancy rate has increased by almost 700 basis points, climbing from a pandemic low of 78.1% to 85.0% as recently as the third quarter of 2023.

This milestone is a testament to the resilience of the whole industry, spurred by significant demand from an aging population and the tireless efforts of senior housing providers to ensure the safety and well-being of their residents.

The Momentum Continues: Projected Occupancy Recovery by 2024

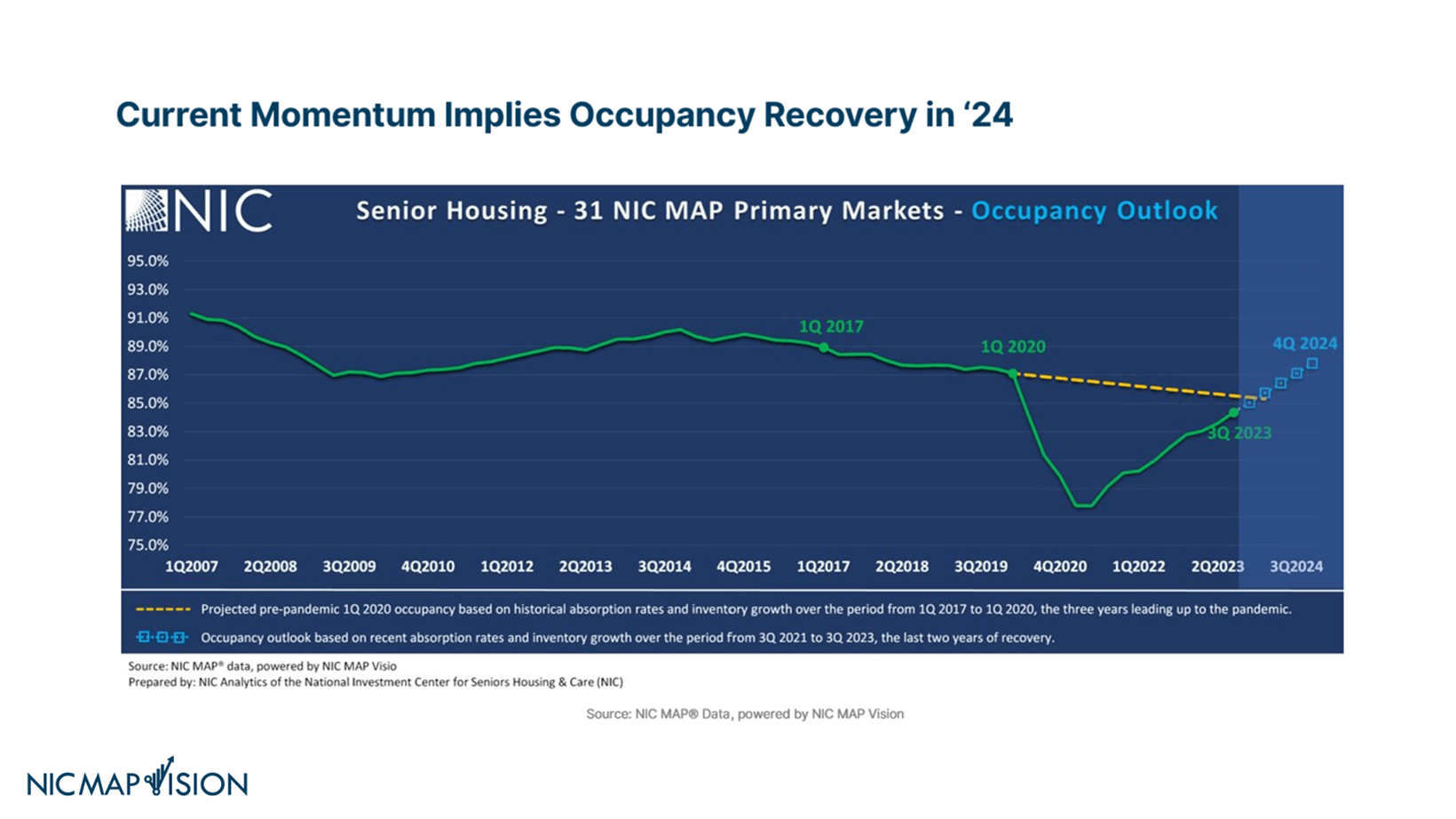

The current momentum that’s building within the senior housing sector is certainly promising. So much so, that if projected trends continue, we can expect to see full occupancy recovery by the end of 2024. These projections are based on a recent analysis that leveraged NIC MAP® Data and offers a projected occupancy outlook based on both absorption and inventory growth recovery rates over the last two years.

The current momentum that’s building within the senior housing sector is certainly promising. So much so, that if projected trends continue, we can expect to see full occupancy recovery by the end of 2024. These projections are based on a recent analysis that leveraged NIC MAP® Data and offers a projected occupancy outlook based on both absorption and inventory growth recovery rates over the last two years.

Why is this rapid recovery so important for those in the market?

- A projected full recovery signals strong market confidence from the target audience. It also suggests that despite the setbacks of the recent past, the senior housing industry remains a vital and growing sector of the economy—one that’s essential to adequately meet the needs of an aging population.

- Occupancy rates directly correlate to senior housing revenue. A return to pre-pandemic (or better) occupancy levels indicates a healthier economic outlook for senior housing facilities. Regaining pre-pandemic occupancy allows investors and operators the chance to evaluate their profit margins, many of which have been greatly narrowed since the onset of the pandemic due to a combination of declining occupied revenue and increased pandemic expenses.

- The sector’s forecasted recovery strengthens the case for senior housing as a viable and attractive investment opportunity. The rapid recovery post-pandemic demonstrates the sector’s ability to navigate crises, making it a relatively safe bet for those looking to invest in industries that can weather major economic downturns. Beyond just recovery though, the upward trajectory across the industry suggests that there’s a strong potential for further growth within the sector, which can open doors for further investment opportunities, especially in emerging markets or areas with aging populations.

- A return to pre-pandemic occupancy will help ignite a much-needed development cycle, accelerating the process of adding more senior housing units across the country to accommodate the growing number of potential occupants.

A Bright Horizon

As we reflect on the journey of the senior housing industry from the pre-pandemic era through its path to recovery, the sector’s resilience and robustness stand out. NIC MAP’s data underscores a story of triumph over adversity, with occupied units bouncing back—and even surpassing—pre-pandemic levels.

The projected recovery to reach full occupancy by 2024 speaks volumes about the industry’s ability to satisfy consumer demand. Investors and operators alike can look forward to a coming landscape that’s ripe with opportunities and driven by high consumer demand..

In these trends, we see a testament to the enduring appeal and necessity of senior housing. The future in the senior housing sector is bright, and the industry is undoubtedly poised for a resurgence that not only meets but celebrates the needs and preferences of its residents.

Want to discover more about what NIC MAP data is saying about past and future trends? Connect with our team today to learn more.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.