Top 20 Most Challenging and Least Challenging Markets for Senior Housing Development

February 20, 2020

The location of senior housing is extremely important and can have a direct impact on a community’s overall performance. As such, senior housing developers spend a significant amount of time and resources to strategically select the markets they want to build in. In addition to analyzing various senior housing demand drivers within a given market, a savvy developer will consider the different factors that impact the level of difficulty associated with developing in that market.

At VisionLTC, we maintain a nationwide database of senior housing projects in various stages of the development process, including pre-planning, planning, bidding, and under construction. We also track developments that have been shelved or abandoned for any number of reasons. Each project includes data regarding sponsor, timeline, configuration, size, cost, status, and other key details. We recently conducted a nationwide analysis to determine the top 20 most challenging and least challenging Metropolitan Statistical Areas (MSAs or “markets”) for senior housing development.

How We Ranked the MSAs

We used a specific formula to rank MSAs from the most challenging to the least challenging in which to develop senior housing. We included 180 MSAs in the analysis, and for an MSA to be included, it needed to have at least 10 total development projects enter any phase of the development cycle between January 2016 and the end of October 2019. In the analysis, we included every type of senior housing development except for adult daycare.

To determine which MSAs are most challenging for development, we calculated the “MSA Abandoned to Total Ratio (%)” which represents the number of abandoned senior housing developments in the MSA divided by the total senior housing developments in the MSA between January 1, 2016 and October 31, 2019. The number of total senior housing developments is equal to the sum of abandoned projects, active projects, and completed projects. The MSAs with the highest ratios represent the most challenging markets for senior housing development.

To determine which MSAs are least challenging for development, we calculated the “MSA Completed to Total Ratio (%),” which represents the number of completed senior housing developments in the MSA between January 1, 2016 and October 31, 2019 divided by the total senior housing developments in the MSA over the same period. The MSAs with the highest ratios represent the least challenging markets for senior housing development.

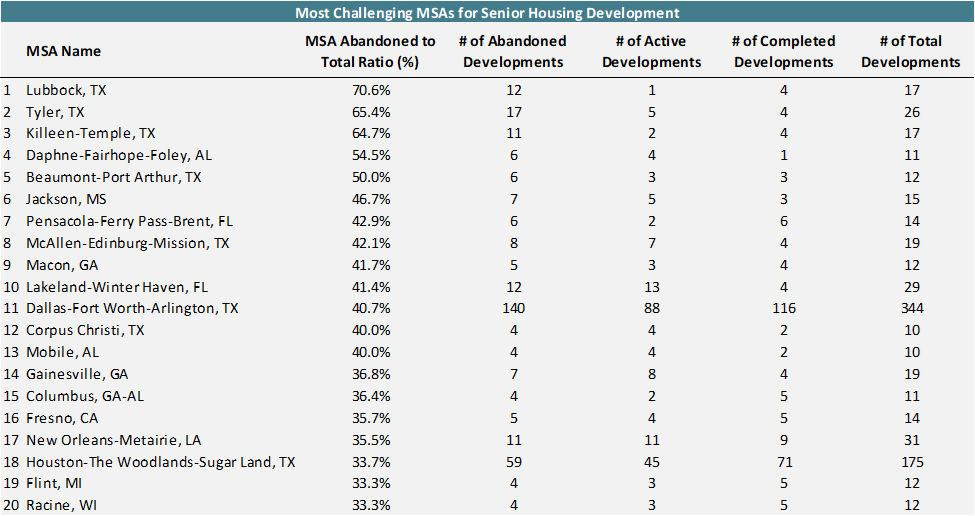

Most Challenging MSAs for Senior Housing Development

*Analysis period = January 1, 2016 – October 31, 2019

Above are the top 20 most challenging MSAs for senior housing development. Not shown in the table is Ocala, FL, which tied Flint, MI, and Racine, WI with an MSA Abandoned to Total Ratio of 33.3%. Interestingly, the top 20 is dominated by the state of Texas, with 8 MSAs from the Lone Star State making the list. Although the markets above have the highest MSA Abandoned to Total Ratios in the country, developers shouldn’t be completely deterred from building in these areas; however, it would be prudent to conduct thorough due diligence before entering into any stage of the development process in these markets to increase the likelihood of the development reaching completion.

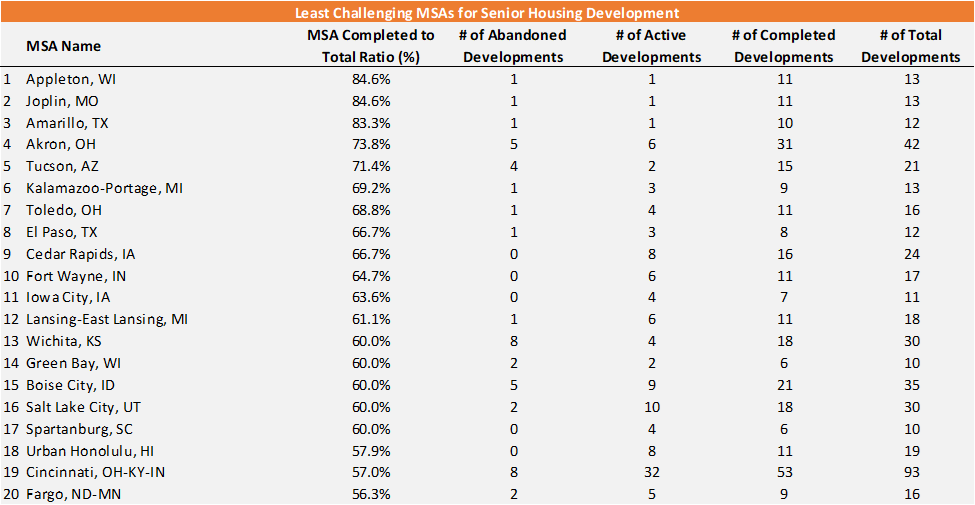

Least Challenging MSAs for Senior Housing Development

*Analysis period = January 1, 2016 – October 31, 2019

Above are the 20 least challenging MSAs for senior housing development. Not shown on the list is Cape Coral-Fort Myers, FL, which tied Fargo, ND-MN at #20 with an MSA Completed to Total Ratio of 56.3%. As you can see, this list is comprised of a variety of markets representing 16 different states across the country. While the data shows that these markets have the highest MSA Completed to Total Ratios nationwide, additional research and factors should be considered to determine if any of these markets are suitable for new senior housing development.

Final Takeaway for Senior Housing Developers

At VisionLTC, we offer a robust market research platform that empowers developers to identify the best location for their next senior housing project, and while we’ve conducted research to provide a list of the most and least challenging markets for development, there are many additional factors that impact whether a project reaches completion in a given market.

The reason for abandoning a development can be market-related, such as a developer’s ability to overcome strict permitting or zoning regulations. However, there are other factors unrelated to the local market that can cause a developer to abandon a project, such as the inability to obtain financing, unforeseen economic changes, or sudden change of the developer’s business strategy. Due to the myriad of factors impacting whether a project reaches completion, it’s prudent for developers to implement a comprehensive market research strategy to better determine whether a given market aligns with their expectations and business objectives.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.