Workforce Contraction and Recovery Varies Across Healthcare Sectors

The impacts of the pandemic and resulting workforce contraction affected healthcare industries differently. Nursing care facilities, continuing care retirement communities (CCRCs), and assisted living properties have experienced a longer workforce contraction compared with other adjacent healthcare industries.

In this blog, we provide context on jobs in the skilled nursing and senior housing sectors, by looking at employment patterns since March 2020, including workforce contraction and recovery, as well as wage increases, compared with other adjacent healthcare industry groups.

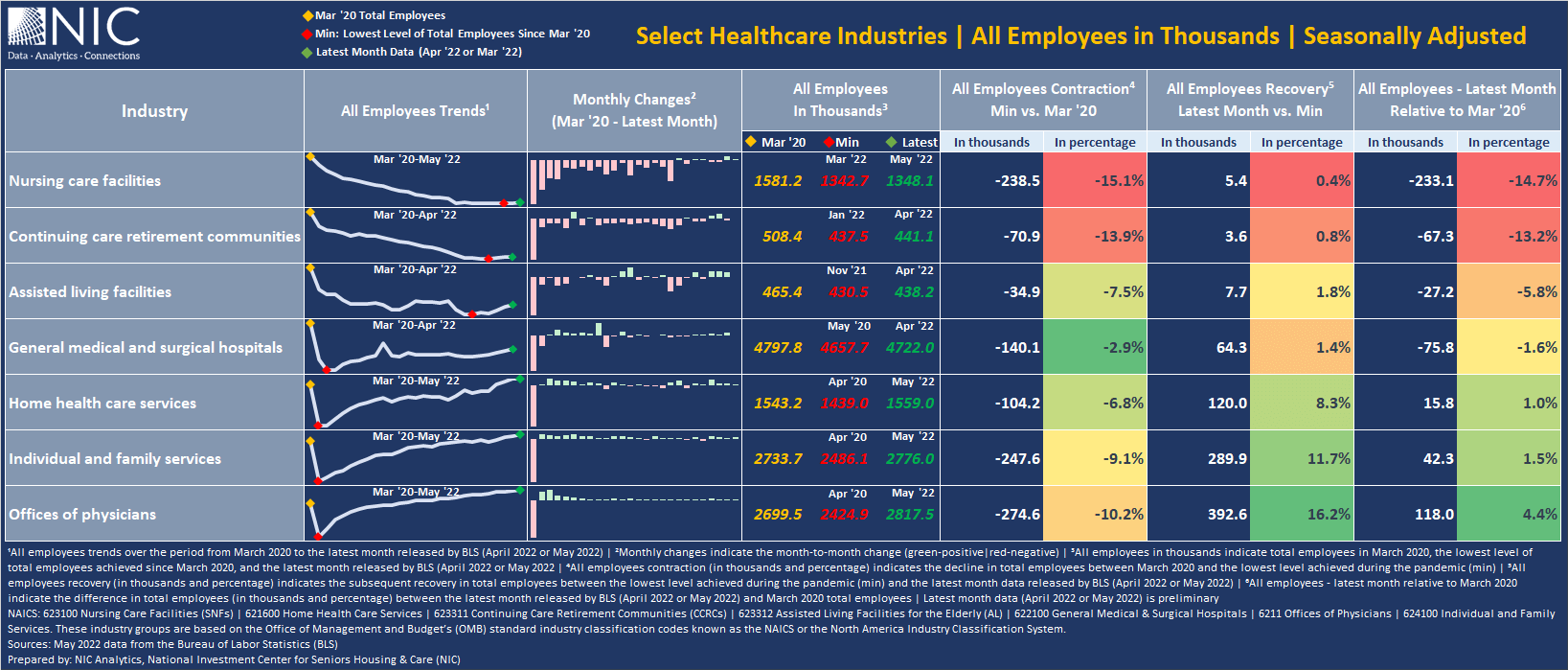

Total Employment in Skilled Nursing and Senior Housing Inching Back but Remains Far Below March 2020 Levels

According to the latest Bureau of Labor Statistics (BLS) data, the seasonally adjusted number of employees at skilled nursing properties dropped by 238,500 jobs or 15.1% over the period from March 2020 to March 2022. From March 2022, employment in skilled nursing edged up by 5,400 jobs and stood at 1,348,100 in May 2022, but still 233,100 jobs below pre-pandemic March 2020 levels (1,581,200), equivalent to negative 14.7%.

Similarly, the number of workers across CCRC and assisted living dropped significantly during the height of the pandemic, with a decline of 70,900 and 34,900 jobs respectively, equivalent to negative 13.9% for CCRC (from March 2020 to January 2022) and negative 7.5% for the assisted living workforce (from March 2020 to November 2021). The good news is total employment within the CCRC and assisted living sectors inched up in recent months by 0.8% (3,600 jobs) and 1.8% (7,700 jobs) from their pandemic related lows, respectively, but unfortunately remained far below pre-pandemic March 2020 levels, with negative 13.2% for CCRC (negative 67,300 jobs) and negative 5.8% for assisted living (negative 27,200 jobs).

These stats show that assisted living is experiencing a relatively fast workforce recovery compared with CCRC and skilled nursing. Notably and as background, NIC MAP data shows that occupancy and demand levels (as measured by the change in occupied units) for assisted living have been recovering relatively fast also compared with skilled nursing and CCRCs.

Interestingly and as Exhibit 1 below shows, employment across adjacent healthcare industry groups, including general medical and surgical hospital, home health care services, individual and family services, and offices or physicians dropped in the very early months of the pandemic, but the level of workers across these industries began to recover back in April and May of 2020. In fact, the latest BLS data shows that as of May 2022, total employment surpassed pre-pandemic March 2020 levels by 1% for home health (+15,800 jobs), 1.5% for individual and family services (+ 42,300 jobs), and 4.4% for offices of physicians (+118,000 jobs).

The relatively fast recovery across these healthcare industries suggests that (1) these sectors have been successful in attracting and retaining workers during the pandemic, some of whom may have been part of the senior housing and skilled nursing workforce prior to the pandemic, and (2) demand has been relatively strong compared with skilled nursing and senior housing.

The level of employment in home health care services and individual and family services took two years to fully recover and return to March 2020 levels while labor across skilled nursing properties, CCRC, and assisted living began to recover just recently and will likely take some time to fully recover.

There are many factors that will influence workforce recovery for senior housing and skilled nursing. These include broad macroeconomic market conditions, the continuing COVID-19 pandemic, the size and growth of the labor force, demand patterns, and more importantly competitiveness. The relatively fast workforce recovery for home health care services and other healthcare industries is a notable difference.

Further, the relationship between labor and demand for the senior housing and skilled nursing sectors has never been strong and will remain critical. In some instances, if labor isn’t available, new residents can’t be admitted. The pandemic has shown that both residents and staff are part of the success equation for a smooth recovery.

Exhibit 1 – Workforce Contraction and Recovery Across Select Healthcare Industries

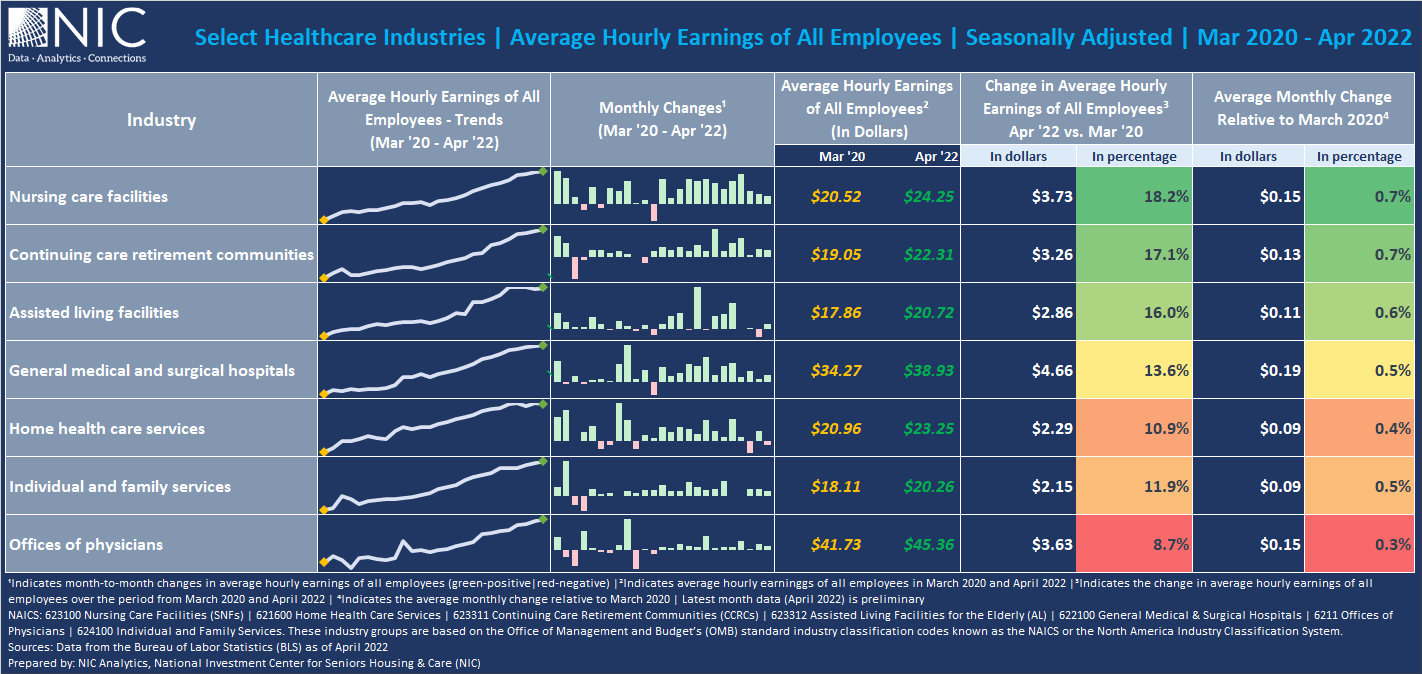

Exhibit 2 below shows that from March 2020, average hourly earnings for all employees at skilled nursing properties rose by $3.73, or 18.2% percent, to $24.25 in April 2022, averaging $0.15 or 0.7% increase on a monthly basis. Over the same period, average hourly earnings for CCRC and assisted living have increased by 17.1% to $22.31 and 16% to $20.72, respectively. These percentage increases in skilled nursing, CCRC, and assisted living wages were the largest across the select healthcare industries in Exhibit 2 below.

At $24.25 per hour on average, workers within skilled nursing are paid 8.7% ($1.94) above CCRC ($22.31), and 17% ($3.53) above assisted living (20.72). Relative to other industry groupings, wages for skilled nursing are also competitive. In March 2020, skilled nursing workers were paid slightly less than those in home health care services. However, skilled nursing workers are now paid better than those in home health care services ($23.25) by $1 or 4.3%, and $4 more than those in individual and family services ($20.26), equivalent to 19.7%.

Despite the competitive wages in skilled nursing compared with other healthcare industry groups, the fast workforce recovery across home health care services and individual and family services, shows that the factors driving workforce recovery go beyond competitive wages.

Staffing has always been an issue for the senior housing and skilled nursing sectors. Now, however, staffing challenges have been exacerbated by a shrinking labor force and continue to be a major area of concern, both for the ongoing recovery and for the sectors’ future capacity to compete in the healthcare industry.

Exhibit 2 – Average Hourly Earnings of All Employees Across Select Healthcare Industries

These wage comparisons capture the average hourly earnings (mean) of all employees. In future commentaries and upcoming NIC Notes blogs, NIC Analytics will compile 2021 data from the Bureau of Labor Statistics to provide a detailed overview of occupational employment and wages for nursing staff (registered nurses, licensed practical and licensed vocational nurses, nursing assistants, and home health and personal care aides) by state, and pinpoint where skilled nursing facilities and senior housing properties (CCRC and assisted living) stood in 2021 compared with the competitive landscape (i.e., other industries & healthcare settings).

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.